ETF/No Load Fund Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

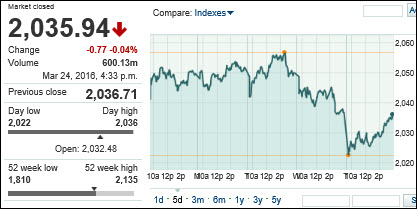

MARKETS UNCHANGED FOR THE DAY BUT DOWN FOR THE WEEK

1. Moving the Markets

Heading into the long weekend, U.S. stocks showed weakness amid renewed talks of a coming interest rate hike from the Federal Reserve, a resurgent dollar and falling oil prices, putting an end to their five-week winning streak.

Investor sentiment has cooled following the terror attacks in Brussels as well as comments the past two days from St. Louis Fed President James Bullard that hinted that the next interest rate hike could come sooner than investors have anticipated.

We were also digesting economic news. Durable goods, or sales of long-lasting, big-ticket items like refrigerators and washing machines, fell 2.8% in February. The weak reading suggests “that companies and households are still very cautious in their spending,” Steven Ricchiuto, chief economist at Mizuho Securities USA told clients in a report.

As a side note, Thursday marked the end of the trading week. U.S. financial markets are closed Friday in observance of Good Friday.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

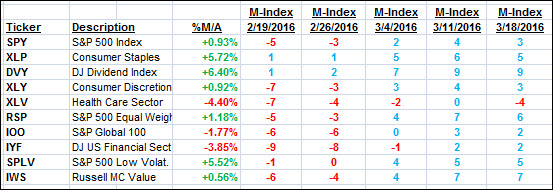

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

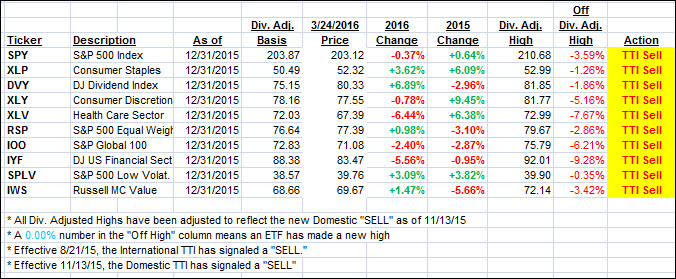

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) weakened and headed closer towards its long-term trend line. We are still in neutral territory and are waiting for the markets to give us a clue as to its further direction.

After the gigantic short covering rally of the past few weeks, it appears that the indexes have run out of steam for the time being. Looking at the technical indicators, we are right at the inflection point where the markets could break either way.

Here’s how we closed this week:

Domestic TTI: +0.27% (last Friday +0.60%)—Sell signal effective 11/13/2015

International TTI: -3.73% (last Friday -2.67%)—Sell signal effective 8/21/2015

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli