ETF/No Load Fund Tracker StatSheet

————————————————————-

————————————————————

Market Commentary

OIL DRAGS MARKETS HIGHER

1. Moving the Markets

The rebound rally continued and sent stocks to their highest point of the year as oil prices jumped and investors continued to assess the European Central Bank’s additional stimulus measures. After yesterday’s disappointment, today it was all euphoria and “risk-on” as the bull market celebrated its seventh anniversary this week leaving the Dow and S&P at their highest closes since the end of 2015.

Perhaps what is even more significant is that, with the big gains today, the Dow and S&P 500 have almost wiped out losses to date, with the Dow down 1.2% and the S&P down 1.1%.

The impetus for the surge in stocks today came from oil, which rallied after the International Energy Agency said “there are signs that prices might have bottomed out.” In its monthly oil market report, the Paris-based organization that represents the world’s major oil-consuming nations, said supplies dropped in February by 180,000 barrels per day. But it also noted a sharp slowdown in demand growth, particularly in the United States and China. Given the fundamentals, I won’t hold my breath in regards to a bottom in oil having been formed already—or in equities for that matter.

Be sure to review section 3 below for the exact timing of the next potential Domestic Buy signal.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

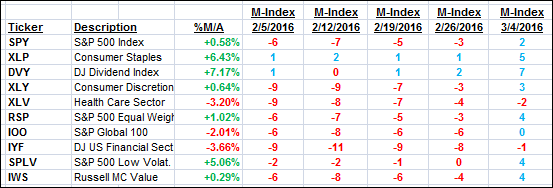

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

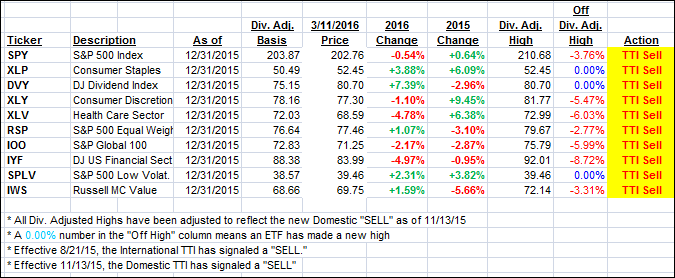

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) improved again and is now positioned within striking distance of crossing its long-term trend line to the upside. In order to minimize the odds of an immediate whip-saw signal, should this crossing occur, I will want to see a clear piercing of the line followed by some staying power before issuing a new Domestic Buy signal.

To me a “clear piercing” means that we need to rally to about +1% above the trend line before I will ease back into selected equity ETFs. Stay tuned as we get closer.

Here’s how we closed this week:

Domestic TTI: -0.20% (last Friday -0.41%)—Sell signal effective 11/13/2015

International TTI: -3.64% (last Friday -4.63%)—Sell signal effective 8/21/2015

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli