ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

MARKETS CLOSE OUT ANOTHER WEEK OF GAINS

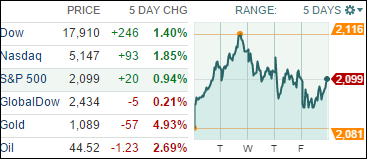

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks ended mostly higher Friday and bond yields spiked after an impressive October jobs report may increase the odds that the Fed will pull the trigger and raise interest rates for the first time in nearly a decade at its next meeting in December.

Despite the S&P 500 sinking fractionally on Friday to just under 2100, all three major indexes posted their sixth straight week of gains. Over the past five trading sessions, all three rose 1% or more.

The employment report that had analysts’ heads spinning today showed that 271,000 jobs were created in October. This was almost 100,000 more than the 182,000 figure that had been projected. The only fly in the ointment was that, when looking under the hood, all gains went to the age group of 55-69, while the 24-54 year olds actually lost jobs—not anything that MSM found worthy of reporting.

Stocks continue to recover with flying colors from the market’s first correction, a drop of 10% or more, that hit in late August. The rebound has been fueled by better-than-expected third-quarter earnings in the U.S. (after sharply lowered expectations) and economic stimulus from central banks in Europe and China. Let’s see if the market can continue to find more upside momentum next week.

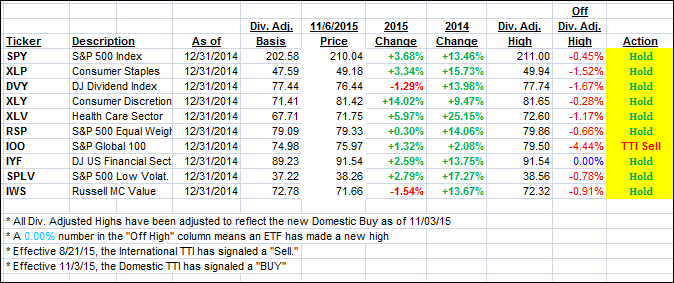

Only 2 of our 10 ETFs in the Spotlight managed to eke out a gain today with the leader being the Financials (IYF) at +0.70%, while the Select Dividend ETF (DVY) gave back the most losing -1.34%.

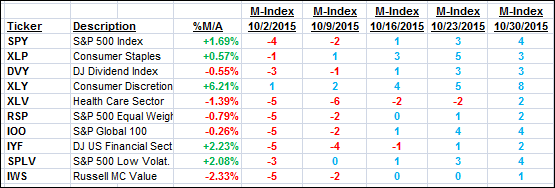

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) remains on the bullish side while the International one is still stuck in bear market territory.

Here’s how we closed this week:

Domestic TTI: +0.44% (last Friday +0.24%)—Buy signal effective 11/3/2015

International TTI: -2.71% (last Friday -2.76%)—Sell signal effective 8/21/2015

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

Reader Chris:

Q: Ulli: Hopefully the market can inch 3-4% higher which will allow me to unload most of these ETFs (with a modest profit), which sadly performed disastrously during the latest Aug. 24th flash crash e.g. SPLV. I’m going to stick with mostly SPY and XLP for my portfolio allocation, which both held up quite well during the 8/24 flash crash, meaning these two didn’t implode 40% during first 15 minutes of trading like some of these ETFs.

What scares me the most are the half baked answers both BlackRock and Schwab traders told me when trying to figure out reasons for this latest flash crash. I’m not sure anyone truly knows or is willing to share for fear of a market panic. My opinion leans to a hidden flaw in ETFs somewhere deep in their weighted algorithms that occurs during fulfillment of an order during massive selling, which results with a miss-match of buy/sell orders which will accelerate the ETF stock price plunge until a buyer is assigned to the order. I read an article about 10 years ago hinting this could happen someday.

I wanted to get your opinion re: Warren Buffet’s request for his Will and estate to use a 90-10 allocation with 90% in a Vanguard S&P 500 index fund and remaining 10% in short term bonds. My question is in a rising interest rate environment; won’t short term bonds also get hurt, albeit less so compared to mid to long term rates? I’m considering finding a short term bond ETF for about 5% of my assets, basically to park cash and use instead of selling my ETFs for cash; one that offers both a modest yield and has a decent Beta.

Many thanks for all your helpful insight.

A: Chris: I appreciate your feedback. Yes, when the markets eventually head south in a big way, it pays to be quick pulling the trigger and getting out and also not having a lot of positions to worry about. I agree with your SPY/XLP assessment.

In regards to Buffett, many investors try to emulate what he does forgetting that they are not in the same financial position he is in. So, if he wants to have 90% of his money buying and holding an S&P index fund, then fine. He can afford to lose 50% when the markets tank and still continue to live a charming life. For the average Joe, another 50% drop will prove to be quite devastating and very difficult to make up.

10% in a short-term bond fund maybe OK, but should interest rates “normalize” at some point, that will be a losing proposition as well, unless, he buys the actual bonds and holds them to maturity.

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli