ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

DIVE ON WALL STREET CONTINUES; DOMESTIC TTI SELL SIGNAL CONFIRMED

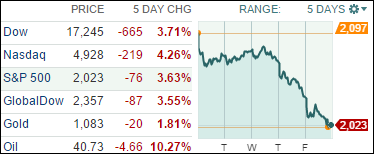

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks fell sharply again Friday as Wall Street suffered a third straight day of losses and the worst weekly loss in 10 weeks.

It seems investors are finding more reasons to hold off on buying stocks, with worries ranging from overvalued stocks, higher interest rates, weak results from key retailers like Macy’s (M) and ongoing angst over the impact of China’s economic slowdown.

Traders were also digesting October retail sales numbers that disappointed, which added to more recent fears about the strength of the Holiday selling season prompted by weak earnings and guidance from department stores Macy’s and Nordstrom.

Oil prices continued to fall as well today, as the U.S. benchmark crude was on the verge of dropping below $40 a barrel. West Texas Intermediate crude dropped 2% to $40.77 a barrel.

This morning, when checking the markets, I was greeted with a sea of red numbers around the world. So I did what I posted yesterday by not only liquidating some of our sector funds but I opted to go to cash 100%. Good thing as the downside momentum accelerated into the close, which may not bode well for Monday’s opening.

This brings to an end a very short domestic Buy cycle, which lasted barely 10 days. Again, the idea of Trend Tracking is to sidestep portfolio destroying bear markets. To accomplish this goal, we will have to occasionally participate in “whip-saw” signals, which are simply a form of insurance we have to pay in order to avoid a potential disaster. For the exact TTI numbers, please see section 3 below.

As the sell-off gained steam, all of our 10 ETFs in the Spotlight headed south with the worst performer of the day being Consumer Discretionaries (XLY) by surrendering -2.63%. Holding up well was Healthcare (XLV), which posted a modest -0.24% loss.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

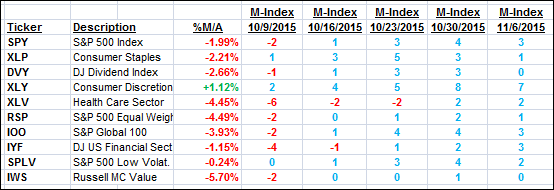

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

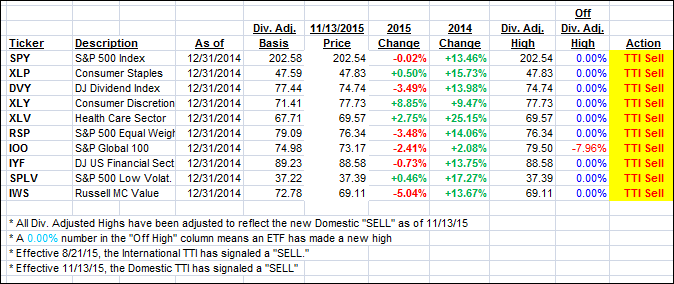

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Domestic Trend Tracking Index (TTI) confirmed yesterday’s bearish bias by slipping deeper into bear market territory putting us now in a 100% cash position. On the international side, we’ve been bearish since 8/21/15.

Here’s how we closed this week:

Domestic TTI: -1.17% (last Friday +0.24%)—Sell signal effective 11/13/2015

International TTI: -5.05% (last Friday -2.76%)—Sell signal effective 8/21/2015

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli