1. Moving the Markets

Stocks slipped a tad as nervous investors looked ahead to a crucial Federal Reserve decision on whether to raise interest rates. Nine of the ten S&P sectors closed lower today, with the materials and energy sectors leading the decliners. You can probably guess who the lone gainer was: Utilities. Utility stocks have remained a solid go-to play for bearish investors over the past year and continue to do so. Overall, traders remain focused on Thursday’s Fed meeting, where board members have the option of raising interest rates for the first time since 2008 or holding off but signaling their intention to tighten access to credit.

What could delay the rate hike? China. Experts are placing their bets that that the Fed will likely hold off on raising rates at the upcoming meeting due to concerns about China’s economic slowdown. Still, they expect the Fed to push rates higher over the next few years, which could greatly benefit the banking industry—especially lenders that are heavily invested in short-term and variable-rate loans.

In tech today, San Francisco startup, Stipe, announced a ‘revolutionary’ technology that will facilitate the buying and selling of products online. The company unveiled a new set of tools today that will provide businesses the capability to sell products inside mobile apps, rather than redirecting them to a 3rd party website. Stripe says it is trying to fix a major issue in the mobile consumer space, given that mobile devices account for 60% of browsing traffic for shopping sites but only 15% of purchases. Stripe is just one of a growing number of digital payments companies—among them is Twitter co-founder Jack Dorsey’s Square which is poised for an initial public offering by year’s end. But Stripe has nonetheless developed quite a following in the world of tech and finance. It has raised about $300 million and private investors value the company at $5 billion.

All of our 10 ETFs in the Spotlight slumped as the indexes meandered without clear direction. Consumer Discretionaries (XLY) led the downside with -0.53% and the Dividend ETF (DVY) held up best by giving back only -0.28%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

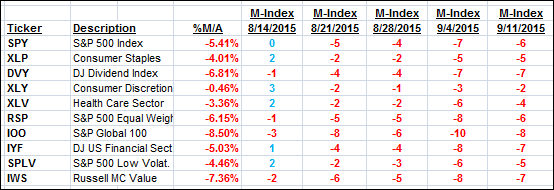

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

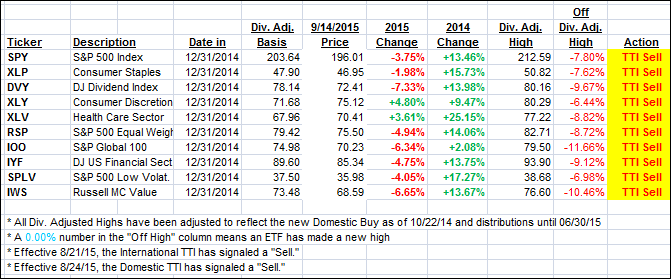

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped a bit as markets were directionless in anticipation of the Fed meeting.

Here’s how we closed:

Domestic TTI: -1.96% (last close -1.79%)—Sell signal effective 8/24/2015

International TTI: -5.77% (last close -5.27%)—Sell signal effective 8/21/2015

Until the respective trend lines get clearly broken to the upside, we are staying on the sidelines.

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli