ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

UNCERTAINTY REMAINS

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks ended the week on a mixed note despite a big early rally Friday after Federal Reserve Chair Janet Yellen’s comments about a potential rate hike.

Yellen gave stocks a broad boost early today after she suggested in a speech yesterday that global economic weakness won’t be significant enough to alter the central bank’s plan to raise its key short-term rate by December.

Uncertainty over the Fed’s timetable for raising rates has been weighing on the market as investors seek clarity on monetary policy was offset later in the day by plunging biotech stocks, which dragged the Nasdaq into negative territory for the day and further into the red for 2015.

Looking forward, Friday’s jobs report will be the marquee economic event. Perceived strength in the report could give the FOMC what it needs to raise short-term interest rates by the end of 2015. Other important economic numbers to watch include construction spending on Thursday and factory orders on Friday.

For the day, 4 of our 10 ETFs in the Spotlight ended up on the plus side as Consumer Staples (XLP) took the lead by gaining +0.66%. Losing big time was Healthcare (XLV), which got slaughtered and lost -2.75%.

Bearish momentum remains alive and well.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

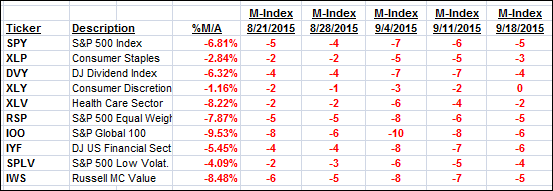

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

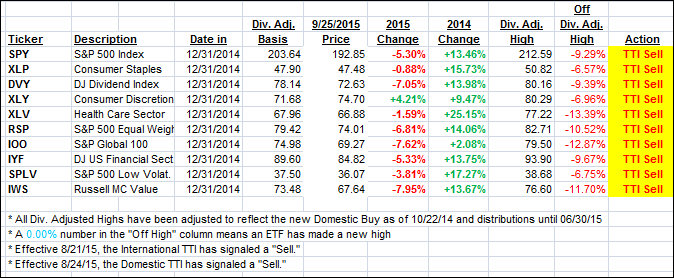

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) plunged this week and moved deeper into bear market territory by the following percentages:

Domestic TTI: -2.49% (last Friday -1.49%)—Sell signal effective 8/24/2015

International TTI: -7.56% (last Friday -5.14%)—Sell signal effective 8/21/2015

Until the respective trend lines get clearly broken to the upside, we are staying on the sidelines.

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

Reader Chuck:

Q: Ulli: Thanks again for all you do. I was just curious about using IOO as an international fund, since it holds so many US based companies. If I m not mistaken, many of the top holdings are US based. I realize that these are multinational corporations, but I just wondered if there wasn’t a better proxy for international investing.

Here’s to low volatility and a rising tide!

A: Chuck: Remember that all 10 ETFs in the Spotlight were chosen based on their ability to withstand sell-offs better than most as measured by my MaxDD% indicator. Given that this was the main criterion, I am sure there are other ETFs that maybe better proxies than IOO, but they may have more volatility as well.

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli