ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

THE BEAR MARKET HAS ARRIVED: DOMESTIC AND INTERNATIONAL TTIs IN “SELL” MODE

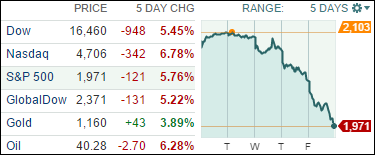

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks have been in a world of pain this week as selloffs continued. The Dow lost 531 points today, dropping to 16,459 and the “C” word (correction) started being floated around Wall Street. As far as my indicators are concerned, we have entered bear market territory, and to me the question is how far down will we go?

Concerns about global economic growth, especially in the world’s second largest economy (China), have been an increasing weight on the stock market. China’s cooling economy has caused the Shanghai index to tumble drastically this week despite a massive government intervention. Throw in uncertainty about when the Federal Reserve is going to raise interest rates for the first time in more than a decade, and investors are losing their confidence in holding onto stocks.

Oil remained under pressure Friday as U.S. crude fell as low as $39.86 a barrel—a level last seen in February 2009 in the depths of the financial crisis. Brent crude, the international benchmark, tumbled 60 cents to $46.02 in London after losing 54 cents the previous day to close at $46.62.

Here in the U.S., economic data released this week was neutral as we saw a mix of surprises to the upside and downside. Housing starts were better than expected, which supports many analysts’ views that the housing market will continue to improve. The Consumer Price Index, which measures inflation, failed to move significantly higher. This lack of price movement could cause more market participants to think that the Fed may wait even longer to raise interest rates.

It will be interesting to see how markets may or may not rebound come Monday.

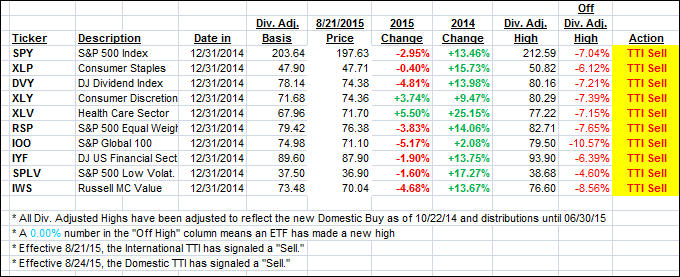

All of our 10 ETFs in the Spotlight headed south with the indexes with Consumer Discretionaries (XLY) faring the worst by losing -3.13%. Holding up best was the Dividend ETF (DVY), which surrendered “only” -2.07%.

For the effect on our Trend Tracking Indexes (TTIs), please read section 3 below:

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

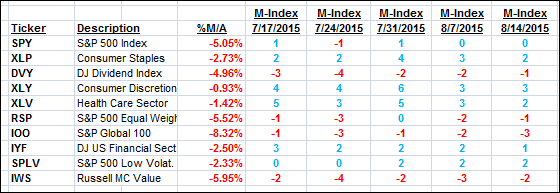

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Both of our Trend Tracking Indexes (TTIs) have now closed below their respective trend lines and are in bear market territory.

The Domestic TTI confirmed yesterday’s bearish tendencies generating a “Sell” signal for that area as well. This affects all “broadly diversified domestic funds/ETFs.”

This break of the trend line to the downside is a serious matter and moving to the safety of the sidelines is the sensible cause of action. In my advisor practice, I started this process today, leaving us with only 1 sector fund, our top performer for the year. If I don’t see green numbers on Monday morning, that one will go on the chopping block as well. For tracking purposes, the effective sell date for the Domestic “Sell” signal will be Monday, August 24, 2015.

Be aware that every major bear market over the past 25 years has been preceded by a Domestic TTI trend line break. Sometimes it has been a false alert, but I personally will not tempt fate and take the chance in challenging the call and potentially be stuck on the bear end of a repeat 2008 market meltdown. Consider yourself warned.

Also note that, as we saw last October, a potential whip-saw signal always remains a possibility. Back then, the turnaround came all of a sudden when Fed Gov Bullard opened his mouth and jawboned about re-instating the QE program. That was all it took and bullish momentum was restored.

I am curious now if another Fed Gov steps forward and announces something along the lines of an indefinite postponement of the eagerly anticipated interest hike in order to put a bottom under this sell-off…

Here’s how we ended up:

Domestic TTI: -2.01% (last Friday +0.64%)—Sell signal effective 8/24/2015

International TTI: -4.91% (last Friday -0.16%)—Sell signal effective 8/21/2015

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

https://theetfbully.com/questions-answers/

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli