ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

A VOLATILE WEEK ENDS UNCHANGED

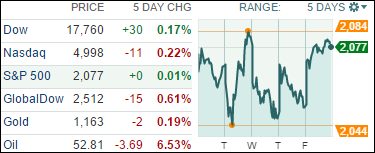

[Chart courtesy of MarketWatch.com]1. Moving the Markets

One look at the above 5-day chart tells the entire story. We had huge swings in the market with the S&P 500 sporting a range of 40 points but ending just about unchanged.

Today’s broad rebound helped the indexes recover from a choppy week that saw a break below the widely followed 200-day moving average (S&P) with our Domestic Trend Tracking Index (TTI) getting ready to break into bear market territory. In the end, new optimism about another deal between Greece and its creditors provided the firepower to push the indexes back to their break-even point for the week.

Despite the stock market meltdown in China, where short sellers are now being threatened with jail terms, and the ongoing Greek saga, Fed chief Yellen reaffirmed that we are still on track in having to deal with an increase in interest rates at some point this year. Yeah, I believe it when I see it…

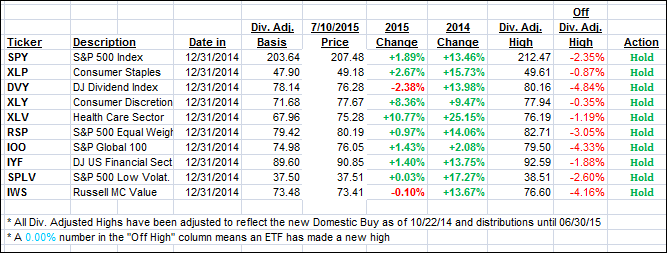

It was no surprise to see that all of our 10 ETFs in the Spotlight joined the bulls and closed higher. The leader was the Global ETF (IOO) with a gain of 2.37%; lagging the bunch were the Dividend ETF (DVY) and Mid-Cap Value (IWS), which both added a more modest 0.81%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

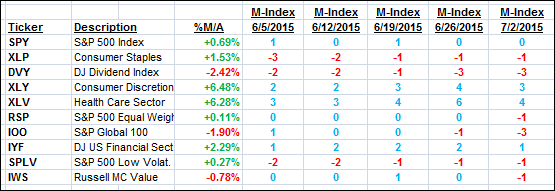

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) rallied and moved deeper into bullish territory after overcoming bearish tendencies this week.

Here’s how we ended up:

Domestic TTI: +0.80% (last Friday +0.92%)—Buy signal effective 10/22/2014

International TTI: +1.07% (last Friday +1.67%)—Buy signal effective 2/13/2015

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

Reader Nitin:

Q: Ulli: With the Greece situation, should we get out of market short term even though your TTIs are still positive?

A: Nitin: I do not recommend it for the following reasons:

- It would put us out of sync with the major trend, which remains up until my Domestic TTI, or our trailing sell stops signal otherwise.

- The Greek situation is a known so, in my view, while market reaction in Europe may be severe, it should be limited in scope here in the U.S. Actually, it may be just a temporary pullback followed by a rebound.

- Should things deteriorate to a point where the bullish scenario turns bearish, our exit strategy will point the way to the sidelines at that time (we’re not all that far away).

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli