ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

STOCKS NOT PERFORMING DESPITE SOLID ECONOMIC DATA

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks finished the week slightly lower despite a solid employment report on Friday. Concerns surrounding Greece continued after a decision to delay repayment of an International Monetary Fund loan. Additionally, the better-than-expected jobs growth continued to drive speculation around a potential hike in interest rates by the Federal Reserve later in 2015. While many analysts believe interest rate increases are likely in the future, they still can’t predict when and how fast they will rise.

It was a good week for economic numbers. Following another winter slowdown, job growth picked up in May as the economy created 280,000 jobs. That was better than the expected gain of 226,000 according to Bloomberg. The unemployment rate edged higher to 5.5%, largely due to more people entering the job market, which is another sign of improvement. And wages rose 2.3% over the past year, the fastest growth since August 2013.

Crude oil settled up $1.13 or 1.95% to $59.13 a barrel. Oil fluctuated around its starting price for much of the day after initially spiking on news OPEC will maintain output at 30 million barrels per day for another six months, keeping a glut in markets.

In tech, we heard a new report today that Twitter (TWTR) announced a secondary offering from existing shareholders. The number of shares up for sale is anticipated to be around 10.4 million.

Next week, retail sales will be announced on Thursday, and the Producer Price Index and University of Michigan Consumer Sentiment Index are scheduled for release on Friday.

9 of our 10 ETFs in the Spotlight continued to slide today, while one of them bucked the trend. The lonely winner was the Financials (IYF) with a gain of 0.38%. On the downside, Consumer Staples led with a loss of 1.43%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

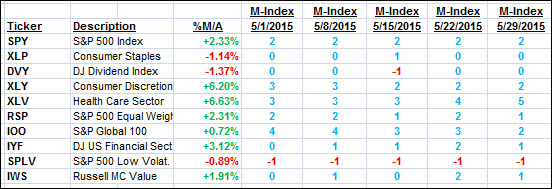

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

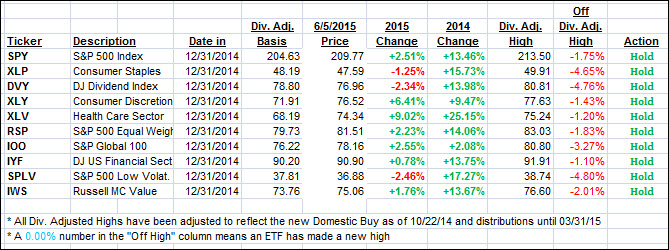

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) retreated with the major indexes but remain bullish. Here’s how we ended this week:

Domestic TTI: +1.70% (last Friday +2.27%)—Buy signal effective 10/22/2014

International TTI: +3.21% (last Friday +4.07%)—Buy signal effective 2/13/2015

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

Reader Chris:

Q: Ulli: Quick question regarding your opinion if/when Greece leaves the EU, could it make the Euro much stronger and in doing so negatively impact the IOO’s ETF performance?

A: Chris: There are many possible scenarios with Greece leaving the Euro. If it’s an ugly divorce and the EU has to swallow the losses of the unpaid loans, which is very likely, then the contagion could spread to the peripheral countries like Portugal, Spain and Italy. Eventually, it will mean the demise of the Euro as we know it, but the timing is unknown. However, if the Euro crumbles, the dollar will rally, and we’ll have to wait and see how domestic equities will be affected.

Keep in mind that we are in uncharted territory with this situation, and no one really has a clue how this will play out. One thing is for sure that you are better off having an exit strategy in place, because things could get ugly in a hurry, and there will be no place to hide except on the sidelines. If you are holding IOO (I don’t), you don’t have to panic; simply follow the trailing sell stop discipline and execute when the market tells you it’s time to do so. That will eliminate any guesswork or having to listen to predictions by others who don’t know either what the future will bring.

Hope this helps.

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli