ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

QUADRUPLE-WITCHING-DAY PULLS INDEXES DOWN AFTER A SOLID WEEK

[Chart courtesy of MarketWatch.com]1. Moving the Markets

The major indexes managed to end the day in the red yet gained nicely for the week. Contributing to today’s cautious stance was the continuing Greek saga as the debt talks ended in the usual deadlock. Adding to the volatility was the always disruptive quadruple-witching-day with options and futures for stocks and indexes expiring simultaneously.

As you can see from the above chart, we had a nice rebound in the S&P early in the week, which was really surprising as the main driving force, the Federal Reserve, did not make any earthshaking statements, so it pays, as always, not to pay attention to any public jawboning but to stay with the major trend.

Of course, all eyes are on Greece and another scheduled emergency crisis summit on Monday after numerous meetings failed to produce an agreement with its creditors. Of course, many analysts are baffled about the domestic equities’ strong performance in the face of the Greek crisis, but I think markets usually react more negatively to sudden unknown events rather than expected ones with simply an unknown timeline. I am sure we’ll find out next week whether this theory holds up this time.

All of our 10 ETFs in the Spotlight retreated after sporting nice gains earlier in the week. Leading the downside was the S&P 500 (SPY) with -1.04%, while Mid-Cap Value (IWS) dropped only by 0.37%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

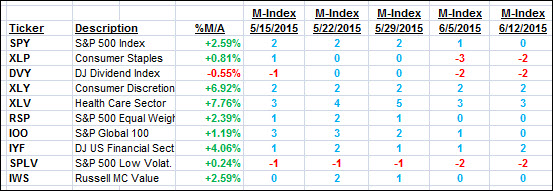

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

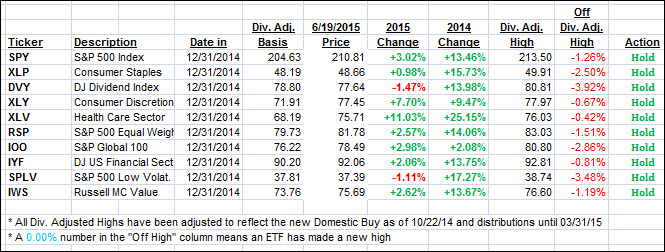

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) pulled back today, but the Domestic one gained on the week as you can see below:

Domestic TTI: +2.13% (last Friday +1.59%)—Buy signal effective 10/22/2014

International TTI: +3.18% (last Friday +3.33%)—Buy signal effective 2/13/2015

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

Reader Bob:

Q: Ulli: I am in the process of rebalancing/creating a portfolio & I am hesitant to allocate 40% or so (I am 64) to bond funds with the likelihood of an interest rate increase coming possibly sometime in 2015. I am thinking it may be prudent to put that 40% (or so) I would allocate to bonds in cash & wait & see what happens in the coming months.

My questions are (1) would you recommend buying a general bond fund (BND) now, or, if not, (2) would you recommend a bond fund focusing on high-yield corporate bonds (VWEHX or ETF equivalent) or intermediate bonds (VFICX or ETF equivalent), or keep the money in cash?

Alternatively, I have also been thinking about simply adopting the Vanguard 4-core portfolio (w/VTI [39%]; VXUS [24%]; BND [27%]; and BNDX [10%], but hesitate to do so because of the bond funds.

Guess I am confused regarding why not sit and wait in cash until the dust settles, while knowing trying to time the market is oftentimes a fool’s game.

I always greatly appreciate your thoughts and wisdom surrounding these complex issues. Hope to hear from you.

Best always to you & yours.

A: Bob: At this time, I personally would not touch any bonds at all. If you look around the world and see the erratic behavior of yields, crushing bond prices in the process, it’s best to stand aside from that asset class for the time being. Cash would be the better option, at least to me, rather than some of the funds you mentioned.

I would stick with whatever portion you have invested in equities subject to my recommended sell stop discipline. Let others take chances with the bond market. There will be a time again where they make more sense than right now. Again, my advice is always the same: If you are hesitant at all, don’t do it, just because some joker thinks the 60/40 allocation scheme is suitable for anyone at anytime.

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli