ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

STOCKS REALIZE SOLID END TO A BUSY WEEK

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks staged a strong rally Friday as the government reported that job gains rebounded in April. This allowed investors to breathe a sigh of relief, as they were hoping that March’s disappointing jobs report was temporary. The report showed that the economy added 223,000 jobs in April, which was significantly higher than job gains in March. All 30 stocks in the Dow index rose, and all 10 of the S&P sectors gained, with materials and energy leading the way.

For the week, all major indexes were higher, while performance across sectors was mixed. Financials were the strongest upward movers this week, while telecom and energy both moved lower. We received mostly upbeat earnings reports across the board as earnings season is coming to a close.

In international news, a big gain in U.K. stocks today pushed European shares to their biggest gain of 2015 after a surprise election victory for the Conservatives kept David Cameron as Britain’s prime minister. The Stoxx Europe 600 Index rose about 2.9%.

As far as other economic data goes, retail sales will be announced next Wednesday and the Producer Price Index is expected Thursday.

All of our 10 ETFs in the Spotlight joined upward momentum and closed higher. The leader was the Global 100 (IOO) with a gain of 1.83%, which was closely followed by Healthcare (XLV) at +1.62%. Lagging the bunch was DVY, which added 0.97%.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

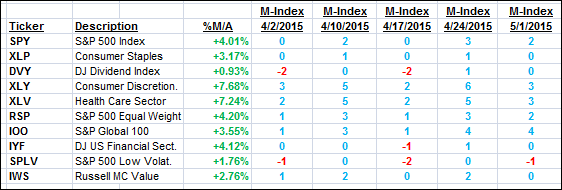

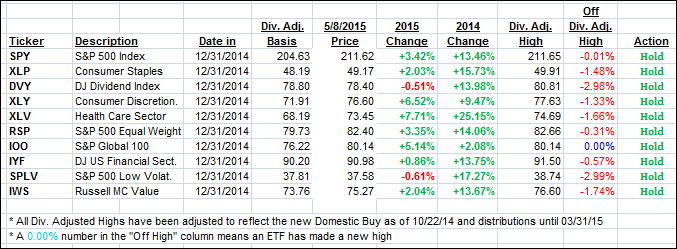

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) recovered and moved deeper into bullish territory.

Here’s how we closed the week:

Domestic TTI: +2.54% (last Friday +2.49%)—Buy signal effective 10/22/2014

International TTI: +5.07% (last Friday +4.64%)—Buy signal effective 2/13/2015

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Chuck:

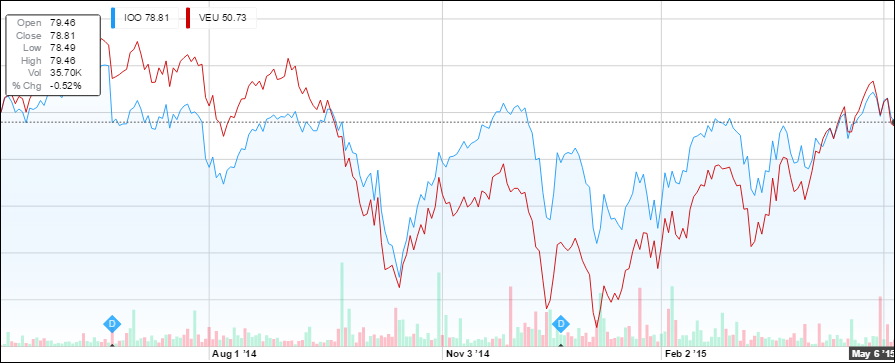

Q: Ulli: Is VEU a good proxy for your international indicator, or do you prefer IOO?

A: Chuck: Neither functions as a proxy; however, as an investment, I prefer IOO, which is why it is a member of the daily featured ETFs in the Spotlight. While performance is similar, IOO sports less volatility and therefore allows us to ride out some market fluctuations without getting stopped out too much.

Here’s a 1-year chart comparison:

As you can see, VEU (red) clearly shows more downside momentum during corrective moves in the market, while IOO (blue) seems to hold up better. That’s why I prefer it.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli