1. Moving the Markets

Markets were in a tizzy today because the Nasdaq closed above 5,000 for the first time since 2000. In addition, the dollar has been raging upwards in valuation over the past couple of months and closed today at an 11 year high on expectations that the Fed may raise interest rates later this year. However, the exact date remains a mystery, as it has been for the past year.

The international bulls continue to charge forward it seems, pushing on from a record breaking February. Today, stock prices were propelled higher due to news from China that there was a surprise cut in interest rates from the country’s central banks, which was unexpected. According to Reuters, the rate cut shaved a quarter point off benchmark lending and deposit rates, less than four months after the last reduction. The cut was sooner than many economists and analysts expected.

In the world of retail, Costco (COST) officially named Citigroup (C) and Visa (V) as the new partners of its credit card program after the deal with American Express (AMEX) expires next year. The agreement will take effect as of April 1, 2016. Citi will be the exclusive issuer of credit cards and Visa will provide all inclusive network support. Financial terms of the agreements were not disclosed. However, Costco said it would provide additional information to its members in the coming months.

9 of our 10 ETFs in the Spotlight joined the surge late in the day and closed higher with Consumer Discretionaries (XLY) leading the way. 4 of them made new highs for the year.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

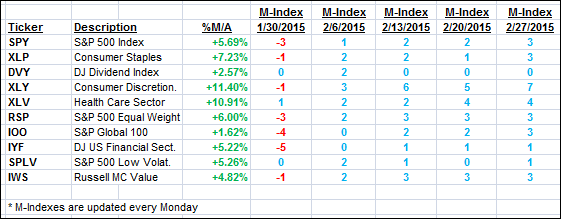

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

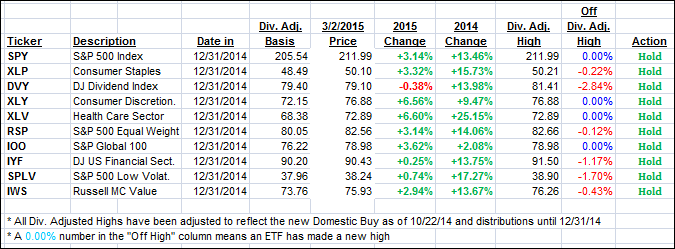

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) joined the party and closed deeper on the bullish side of their respective trend lines.

Here’s how we closed:

Domestic TTI: +4.10% (last close +3.84%)—Buy signal effective 10/22/2014

International TTI: +4.16% (last close +3.76%)—Buy signal effective 2/13/2015

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli