ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, March 6, 2015

STOCKS CLOSE THE WEEK ON A DOWN NOTE

[Chart courtesy of MarketWatch.com]1. Moving the Markets

U.S. stocks fell sharply today as better-than-forecasted jobs data fueled anticipation that the Federal Reserve is moving closer to raising interest rates. Stocks have had an eventful week. On Monday, the Nasdaq composite closed above the 5000 barrier for the first time in 15 years and the Dow Jones industrial average and Standard & Poor’s 500 stock index notched fresh all-time closing highs. Yesterday, both the Dow and S&P 500 rose, ending a brief two-day losing streak.

Economic data for the week was mixed overall, with Friday’s stronger-than-expected employment report prompting market volatility to pick up at the close the week. Data continues to point toward growth of 2.5% to 3% for 2015 in the U.S., which is a stronger pace than most developed economies around the globe—that is if your believe in those forecasts.

Looking forward to the next week, fewer major economic releases are expected. February retail sales numbers on Thursday and the producer price index and University of Michigan sentiment reports on Friday are likely to headline the week on the economic front.

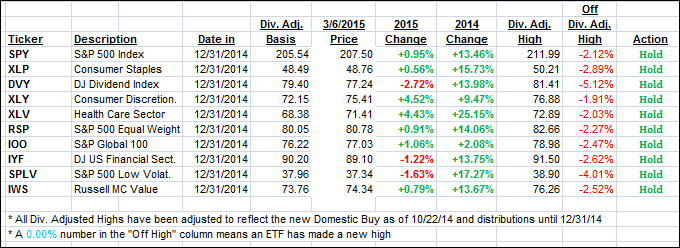

All of our 10 ETFs in the Spotlight succumbed to the bearish forces and closed down with 7 of them holding on to YTD gains as the table in section 2 shows.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

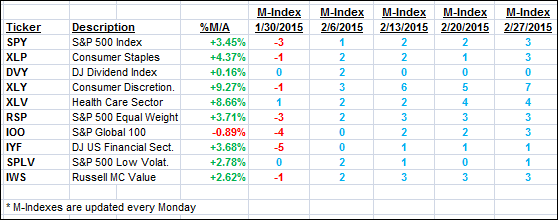

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) took a dive from last Friday’s close but remain on the bullish side of their respective trend lines.

Here’s how we ended this week:

Domestic TTI: +2.74% (last Friday +3.84%)—Buy signal effective 10/22/2014

International TTI: +2.98% (last Friday +3.76%)—Buy signal effective 2/13/2015

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Ed:

Q: Ulli: In looking at the data you have for the ETFS/Funds, what would be the best way to use the data to come up with potential ETF/Fund buys or conversely sells.

I’m not asking for a recommendation, just the process used to pick the best ETF’s/Funds listed. I mostly use Vanguard ETF’s and funds. If you think I should try other fund families, can you tell me the process to find the best ones?

I don’t like funds with high fees or restrictions in trading, although I don’t do that much, other than to balance my holdings. I’d very much the input you can provide.

A: Ed: While there are many ways to use the ETF/MF tables, I personally prefer to select a mix of funds, preference being ETFs, which demonstrate good upward momentum yet have shown historically some decent resistance to market pullbacks.

You can do that by dropping down the ranking list from the top a few spots, which would eliminate those high performers that tend to collapse quickly during corrections. Our goal is to remain invested as long as possible during up trends while minimizing any potential whip-saw signals.

To make it even easier, I selected 10 ETFs in the Spotlight, which are featured and updated in my daily market commentary. They were chosen based on performance and above average resistance to sell offs along with the fact that they are all trading in high volume. Times change and ETF performance rotates, but you can select from that list and/or find the equivalent at Vanguard, if you prefer.

Hope that helps.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli