1. Moving the Markets

Stocks continued to climb as investors were encouraged by Russia and Ukraine announcing a cease-fire. The S&P 500 moved within two points of a record closing high and the Nasdaq is at its highest level since March 2000.

Advances today were mostly led by technology stocks in the Nasdaq. However, Cisco (CSCO) was a big gainer that pushed the Dow higher after it announced earnings that exceeded analysts’ expectations.

We did hear some disappointing economic news today. The number of Americans seeking unemployment benefits jumped last week and jobless claims rose 25,000 to a seasonally adjusted 304,000. In addition, we also heard that retail sales fell 0.8% in January despite lower gas prices.

Do you shop at Costco? Do you use an American Express? Well, shares of American Express (AXP) took a dive today after the company revealed that it is ending its long-standing co-branding relationship with the wholesaler. Amex cards have been the only form of credit accepted at the store, but all that will come to an end on March 31, 2016.

With today’s straight up move, it comes as no surprise that all of our 10 ETFs in the Spotlight joined the party and closed on the plus side. Leading the group was IOO with a +1.36% gain on hopes that the Greek issue can be resolved and that the Ukraine Cease Fire holds. Four ETFs made new highs for the year.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

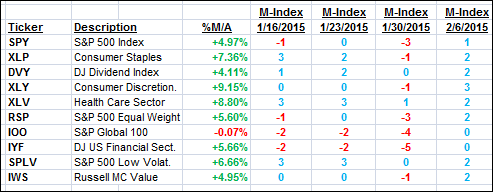

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For hundreds of ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

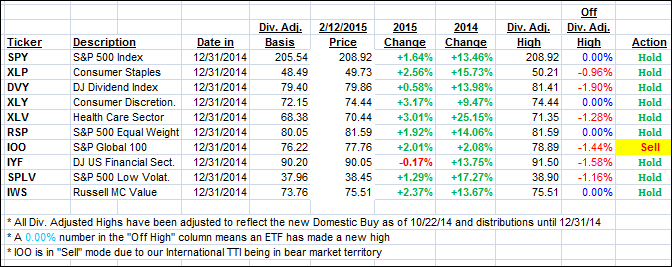

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) joined the rally with the International one gaining sharply. We have now reached a point where it appears that the bearish period has come to an end and a new bull phase is in the making.

Consequently, as of tomorrow, a new International “BUY” signal will be in effect, unless the markets open sharply lower, in which case I will hold off another day. An International Buy signal affects only all “broadly diversified international ETFs/Mutual funds.”

Here’s how we ended up:

Domestic TTI: +3.55% (last close +3.05%)—Buy signal since 10/22/2014

International TTI: +2.01% (last close +0.74%)—Sell signal effective 12/15/14

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli

Comments 2

Hello Ulli!

With the international TTI going (and staying) positive over the last couple of days, would it be a good time to invest or ease into diversified international ETFs, such as VEU? Has enough upside momentum been demonstrated? Or, is this a potential head fake like last November?

Freden,

As I said yesterday (2/12/15) in my commentary, barring any major sell-off this Friday morning (2/13/15), which did not occur, a new Buy signal for the international arena has been generated.

As with any other Buy signal, use my recommended incremental buying process depending on your risk tolerance and, of course, never forget to implement my sell stop discipline. With all that is going in Europe, things could reverse in a hurry. There is no one alive that could tell you whether this is another head-fake.

Ulli…