1. Moving the Markets

Major indexes ended lower today. However, not without seeing a blue sky. Yahoo shares rallied 6% after the company said it would spin off its remaining holdings in Alibaba into a separate entity. Stock in the new investment company created by the tax-free move, SpinCo, will be distributed to Yahoo shareholders. Speaking of Yahoo (YHOO), the company reported a revenue drop to $1.25 billion, slightly down from $1.27 billion in the year-ago quarter, while earnings were about half of what they were, which was $166 million this quarter versus $348 million in 2013.

In more tech news, we heard news from Apple today. Apparently, investors were expecting a huge holiday quarter from the company. Well, Apple did even better. The company’s shares jumped more than 5% today in after-hours trading. Apple said it collected $74.6 billion in sales, up 30% from last year, and also earned net income of $18 billion, up 37%, in its fiscal first quarter, which is the biggest of the year.

We heard great news from the airline industry today. The four major airlines all reported huge profits for 2014 in the past week. Airfares in 2014 were at their highest level since 2003, according to Department of Transportation inflation-adjusted figures. And flights in the USA ran at 81.6% capacity in the first 10 months of 2014 — a record level that is likely to continue to increase. At some airports, such as Atlanta’s Hartsfield-Jackson, Denver International and Orlando, Palm Beach and Fort Myers in Florida, departing flights were more than 85% full last year.

To no surprise, all of our 10 ETFs in the Spotlight joined the downward momentum and slipped; however, 5 of them still remain on the plus side YTD as section 2 shows.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

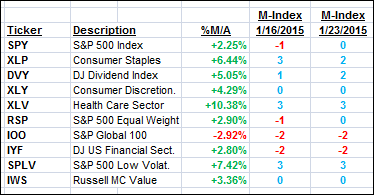

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

For more ETF/Mutual fund choices, be sure to reference Thursday’s StatSheet.

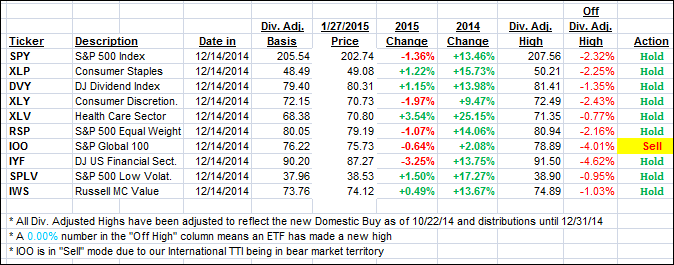

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) both gave back some of the recent gains with the International one now drifting again below its long term trend line.

Here’s how we ended this volatile day:

Domestic TTI: +2.53% (last close +2.99%)—Buy signal since 10/22/2014

International TTI: -0.03% (last close +0.06%)—Sell signal effective 12/15/14

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli