ETF/No Load Fund Tracker Newsletter For November 21, 2014

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, November 21, 2014

STOCKS FINISH SOLID AND MARK FIFTH STRAIGHT WEEK OF GAINS

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks moved higher on the week, which marks the fifth consecutive weekly advance. Markets were boosted by improving economic indicators, solid corporate profits and aggressive monetary policy stimulus from Europe to Asia.

All major indexes finished higher today. The S&P 500 gained 0.52%, the Dow 0.51% and the Nasdaq 0.24%. Once again, the S&P 500 and Dow closed at record highs.

Global markets advanced as well, as central bankers from China and Europe reiterated their support for markets and struggling economies abroad. The global rally was sparked after China announced a surprise interest rate cut and the European Central Bank chief Mario Draghi said the ECB is ready to take additional steps to stimulate the weak Eurozone economy.

The holiday-shortened week ahead is packed with economic data on Tuesday and Wednesday. Housing activity will be in focus with the release of new home sales, pending home sales, and several price indexes. Also getting attention will be Q3 GDP, which is seen being downwardly revised to a 3.3% annualized increase.

We will also hear additional insight into the strength of the consumer via the release of personal income and spending in October. Markets will be closed on Thursday for the Thanksgiving Holiday, and will have a shortened session on Friday.

All of our 10 ETFs in the Spotlight managed to close up today with 5 of them making new highs as the YTD table below shows.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

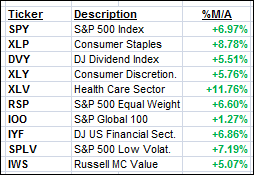

Here are the 10 candidates:

The above table simply demonstrates the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A). A break below, represented by a negative number, shows weakness, while a break above, represented by a positive percentage, shows strength.

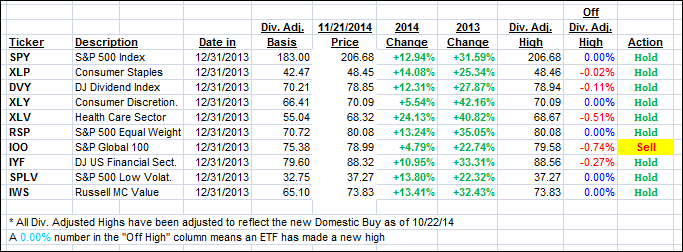

Year to date, here’s how the above candidates have fared so far:

Again, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point has been taken out in the “Off High” column.

3. Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) picked up steam this week with the international one slowly but surely advancing on the plus side of its trend line. Today’s rally confirmed the trend change from bearish to bullish so, effective 11/24/14 the International TTI is back in ‘Buy’ mode. This affects all “broadly diversified international mutual funds and ETFs.”

Here’s how we ended the week:

Domestic TTI: +3.47% (last Friday +3.13%)—Buy signal since 10/22/2014

International TTI: +1.24% (last Friday +0.20%)—New Buy signal effective 11/24/14

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Ed:

Q: Ulli: I have available funds to add to my investments but feel this is not the time. I’m 84 and do not feel comfortable investing with most funds at their record highs. Any thoughts would be appreciated.

A: Ed: The most important thing when investing is your personal comfort level. Nothing else matters more than that; neither the investment method, nor any news, opinions or even my suggested exit strategies for that matter. If you have any discomfort, simply don’t invest until such time that your risk tolerance allows you to do so.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli