1. Moving the Markets

We had hope last Friday that markets were back on track, but those hopes faded late in the trading day today. Stocks closed slightly lower across the board Monday with the tech sector leading the decline

It has become apparent over the past couple of weeks that, apart from global conflicts, many investors remain uncertain about the outlook for stocks due to the Fed nearing the end of its stimulus program and moving toward rate hikes.

Shares of experimental Ebola treatment maker Chimerix (CMRX) rose 6% Monday on word its product is being used to treat a man infected with the virus in Dallas. The Food and Drug Administration has approved the emergency use of the drug.

The biggest gainer today was CareFusion (CFN). Shares are up 23% to $56.88 after Becton, Dickinson & Co (BDX) agreed to purchase the global medical device company for $12.2 billion in cash and stock. However, the deal has yet to be approved by either CareFusion’s shareholders or U.S. regulators.

2 of our 10 ETFs in the Spotlight managed to eke out a gain while the others declined slightly.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

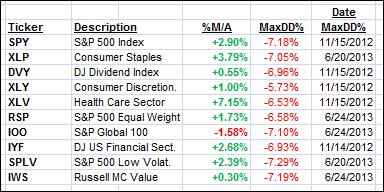

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them, except IOO, are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

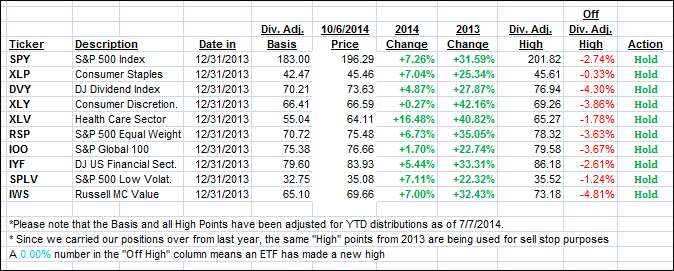

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) barely changed, although the International one showed a slight improvement. Here’s how we ended up:

Domestic TTI: +1.10% (last close +1.11%)

International TTI: -1.74% (last close -02.08%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli