1. Moving the Markets

Markets exploded upwards this afternoon after the latest release of the Fed minutes. The Dow jumped back up 1.64% today, the S&P 500 gained 1.75% and the Nasdaq soared 1.91%. In its statement, the Fed said that it planned to end its market-friendly bond-buying program after this month; however, the Fed also said that it plans to keep the fed funds rate at its current level for a “considerable time” after its bond-buying program ends.

Wednesday’s welcome bounce back might have erased the pain of Tuesday’s plunge, but the U.S. market still is in a relatively precarious state following a turbulent period that still has Dow down 1.7% from its record close on Sept. 19.

Shares of Chimerix (CMRX) are down 9% Wednesday following the death of a person taking the company’s drug to treat an Ebola infection. There is no cure for Ebola to date, however, doctors administered the experimental drug as a last resort hoping that it might be able to save the patient. The company says it will continue developing the drug.

All of our 10 ETFs in the Spotlight joined the party and headed north with one of them making a new yearly high.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

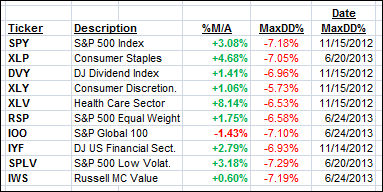

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them, except IOO, are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

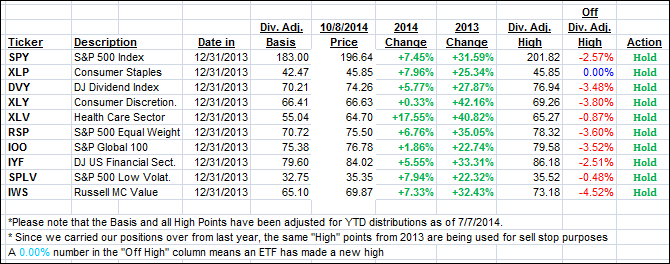

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) stopped yesterday’s downward trend and reversed for the time being with the International one remaining on the bearish side of the trend line:

Domestic TTI: +1.37% (last close +0.39%)

International TTI: -1.99% (last close -2.79%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli