ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, October 17, 2014

JAWBONING THE MARKETS HIGHER

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks fell on the week, despite a Friday rally. Markets ended the day on a much needed positive note though with the major indexes gaining as the weekly chart above shows. In general, markets moved higher today from upbeat earnings reports from heavyweights, such as General Electric (GE), Honeywell (HON) and Morgan Stanley (MS).

A large portion of gains today were also attributed to the rise in the consumer confidence index. The index rose in October to the highest level in seven years, despite the market turbulence. We also heard today that housing starts were higher than estimated, while investors anticipate that central banks will support more economic growth with stimulus.

However, the mother of all news and primary driver of the rally came from the Fed’s Bullard, who mentioned the magic word (QE) as follows:

“We could just end the program in December. But if the market’s right and this is portending something more serious for the U.S. economy, then the committee would have an option of ramping up QE at that point.”

Ah yes, just the mere mention of the fact that QE perhaps maybe ramped up was enough to light some fire in a much oversold market. Whether this will be just one of the many dead-cat-bounces we’ve seen recently remains to be seen. But at least for this day it made everyone forget about the bearishness of the past couple of weeks.

In media, Netflix (NFLX) fell today after about a huge sell-off on Thursday. The company blamed recent price increases on a miss in subscriber growth in the third quarter. Netflix added only 980,000 domestic streaming users versus its target of 1.33 million. Swing and a miss! Additionally, the company is predicting the slowdown will continue in the fourth quarter.

We are fully under way into Q3 earnings reports, so let’s look to next week with a gleaning eye on earnings to see if they will throw an assist to continue today’s comeback.

All of our 10 ETFs in the Spotlight joined the rally and closed up for the day. You can see how this rebound affected our Trend Tracking Indexes (TTIs) in section 3 below.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

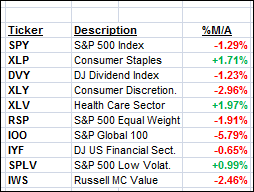

While our Trend Tracking Indexes (TTIs) are in “Sell” mode, I am featuring this table to simply demonstrate the magnitude with which some of the ETFs are fluctuating in regards to their positions above or below their respective individual trend lines (%M/A).

Year to date, here’s how the above candidates have fared so far:

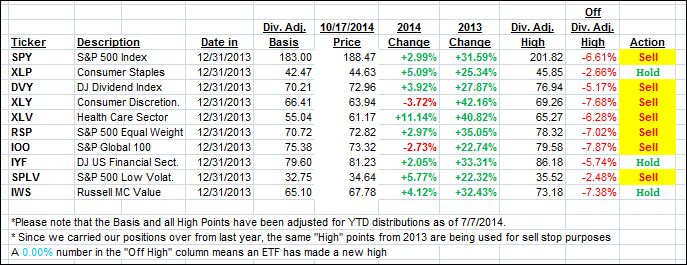

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

The “Action” column has been modified to show the effects of our Sell signals. The current “Hold” positions reflect only sector ETFs, which should be sold based on their respective sell stop points.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) bounced higher today in response to the positive tone in the market. However, we remain bearish but will re-evaluate as soon as the TTIs have not only broken above their trend lines but also have shown some staying power.

Here’s how we ended the week:

Domestic TTI: -0.22% (last Friday -0.39%)—Sell signal since 10/14/2014

International TTI: -4.75% (last Friday -4.81%)—Sell signal since 10/1/2014

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Dennis:

Q: Ulli: Your blog is VERY much appreciated, especially your book “How to Beat the S&P using the S&P 500…” Question: Does your proprietary Domestic TTI affect the way the HOT LIST of 10 ETF’s are managed? If I am tracking correctly, not all of the ETF’s on a Sell have reached a 7.5% sell-stop…have they?

A: Dennis: Yes, the TTIs affect the 10 ETFs in the Spotlight. Absent of any major downturn and, while the TTIs are on the plus side of their respective trend lines, the trailing sell stops give you the signal when to exit the market.

However, if the TTIs move into bear market territory before a trailing sell stop is triggered, then they will override the sell stop discipline. It is the indicator which has reliably signaled major trend changes in the market for some 25 years.

To clarify again, if the International TTI drops below its trend line, it will affect all “broadly diversified international mutual funds/ETFs.” If the Domestic TTI drops below its trend line, all “broadly diversified domestic mutual funds/ETFs” are affected.

Sector and Country funds should be sold based on their respective sell stops giving the signal.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli