ETF/No Load Fund Tracker Newsletter For October 3, 2014

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, October 3, 2014

MARKETS VOLATILE THROUGHOUT THE WEEK, BUT END ON A POSITIVE NOTE

[Chart courtesy of MarketWatch.com]1. Moving the Markets

It was a topsy-turvy week for markets across the globe; however, most indexes recovered a substantial amount today with the S&P 500 gaining 1.12%, the Dow rising 1.24% and the Nasdaq increasing 1.03%. While a lot of news this week centered on the Hong Kong protests and continued conflict in the Middle East, one may have overlooked some of the more positive economic news that we heard.

The U.S. unemployment rate fell to 5.9% in September, the lowest since July 2008, and 248,000 jobs were added. Job gains for July and August were revised up to 243,000 and 180,000, respectively, from the earlier estimates of 212,000 and 142,000. While that looks good on the surface, it’s noteworthy that almost 93 million Americans are not in the Labor force as the participation rate dropped to a 36 year low. So, if you are curious as to what age group snatched up most of the jobs, take a look at “Hiring Grandparents Only.”

Wages remain stagnant however, with average hourly earnings down a penny from August and 2% higher than a year earlier. Also, initial applications for U.S. unemployment benefits fell by 8,000 to a seasonally adjusted 287,000 in the week ended 27 September, and the four-week moving average fell 4,250 to 294,750.

In corporate news, EBay (EBAY) said it plans to spin off PayPal into a separate publicly traded company in 2015. This marks an about-face after eBay’s fight against activist investor Carl Icahn’s push for the company to split. But, other analysts speculate that the decision is possibly prompted by the new Apple Pay service that is seen as a potential competitive threat.

While all of our 10 ETFs in the Spotlight participated in today’s rebound, no new highs were made.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

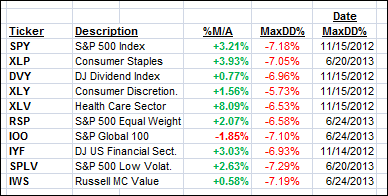

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them, except IOO, are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

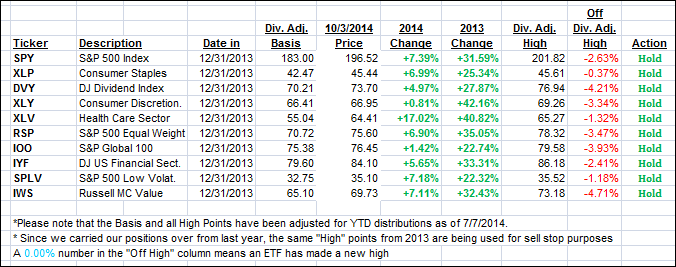

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed this week with the Domestic one remaining on the bullish side of the trend line, while the International one stayed on the bearish side after its Sell signal effective 10/1/14:

Domestic TTI: +1.11% (last Friday +1.55%)

International TTI: -2.08% (last Friday -0.12%)

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Steve:

Q: Ulli: I was reading through the “how to beat the S&P using the S&P and was thinking about capital gains. They wouldn’t be an issue in a 401K but could impact a standard investment account?

On the surface, I’m guessing that missing the downswings would far outweigh any tax consequences on the gains at sale?

Thanks for all the newsletters and commentary. I appreciate that you share your insights.

A: Steve: Yes, I believe that avoiding the big drops is a far more important issue than tax consequences.

In my view, tax issues are secondary while protection and preservation of capital should always be the primary goal. Those that have experienced the bear markets of 2000 and 2008 can certainly attest to that.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli