1. Moving the Markets

The markets were back on track today as both the Dow and S&P 500 closed at record highs. The S&P 500 gained 0.5%, the Dow climbed 0.6% and the Nasdaq trumped as it gained 0.7%.

As you may know, the Scotland independence debate has been all over the news and is hovering over a lot of investor decision making. So much in fact that the British pound surged to a two-year high against the euro today.

And then there’s that Alibaba IPO that has been making headlines of late. The largest IPO in history is nearing the final states of selling its shares to the public today. The stock will trade under the symbol BABA and initial share price is going to be between $66-$68. The $68-a-share IPO price values the company at $170.8 billion.

In federal news, the Federal Reserve made clear yesterday that it would keep interest rates at record lows for a while. Low rates have boosted the market by helping revive the economy and making stocks more attractive compared with bonds.

9 of our 10 ETFs in the Spotlight closed up with 3 of them making new yearly highs.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

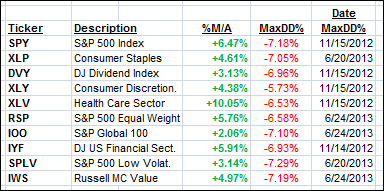

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

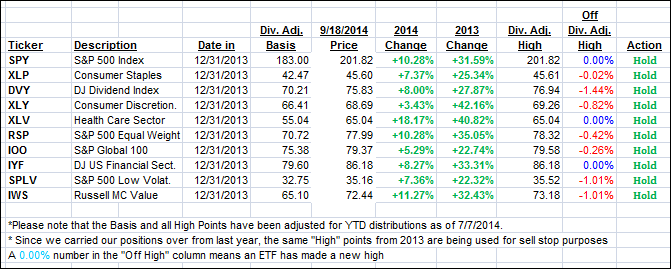

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) picked up speed again and closed as follows:

Domestic TTI: +2.59% (last close +2.32%)

International TTI: +1.85% (last close +1.30%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli