ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, September 5, 2014

MARKETS END THE WEEK SOMEWHAT FLAT DESPITE FAVORABLE ECONOMIC DATA

[Chart courtesy of MarketWatch.com]1. Moving the Markets

Stocks teetered sideways for most of the week, finishing slightly higher by Friday. Despite slower job growth than expected, several economic data points suggest the domestic economy continues to strengthen. For the week, the major indexes gained as the chart above shows.

Moving the markets this week was an aggressive shift in monetary policy in the eurozone, as the ECB cut interest rates and announced a program to purchase bonds to provide monetary stimulus. This is apparently intended to lower interest rates, spark stronger economic growth, which has faltered recently, and ultimately pick up low European inflation.

The stock market also got a lift from a cease-fire agreement between Ukraine and Russian-backed separatists, aimed at bringing an end to nearly five months of fighting.

The week ahead will be somewhat quiet for economic data. Reports will include retail sales, as well as consumer sentiment for September. Retail sales are expected to rebound 0.5% in August, following what was a disappointing flat monthly increase in July.

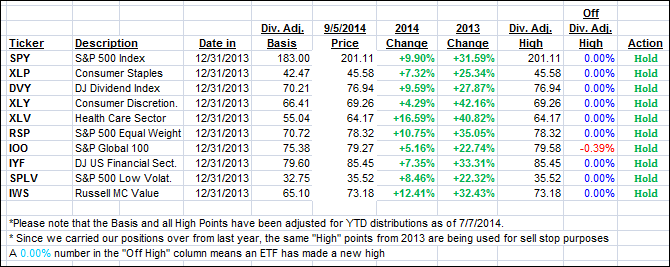

All of our 10 ETFs in the Spotlight closed higher today with 9 of them making new highs for the year.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

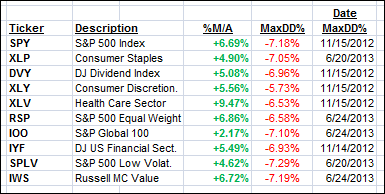

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

Here are the 10 candidates:

All of them are currently in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) vacillated during this see-saw week and closed mixed:

Domestic TTI: +3.00% (last Friday +3.22%)

International TTI: +2.69% (last Friday +2.59%)

Have a nice weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

Reader Roger:

Q: Ulli: Could the ten Spotlight ETFs be used in a portfolio investment strategy or just for a piece of an overall portfolio?

Second, would you logically try to weight the percent investment in each by tracking an appropriate benchmark?

A: Roger: Sure, you can use it as a standalone portfolio, as some readers have done, or, you could use only those ETFs that are showing strong upward momentum, such as I do in my advisor practice.

More importantly, you need to follow my recommended sell stop discipline, to make sure you limit your downside risk should this bull market die all of a sudden.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli