1. Moving The Markets

After the nice boost the markets had yesterday, the blue sky turned grey today as the S&P 500 and Dow both closed lower.

Equities seemed to come under pressure today on speculation that Federal Reserve interest rate hikes may come sooner than expected, despite word that income and spending rose as jobless claims fell. St. Louis Fed President James Bullard told said today on Fox news that the Fed could raise interest rates as early as the first quarter of 2015.

We did see GoPro (GPRO) make some noise in the markets as the stock jumped 30% during its first day of trading. GoPro and its shareholders raised approximately $427 million from selling 17.8 million shares. The management of the action camera maker plans to use the proceeds from the public offering to repay its debts and to acquire complementary businesses or assets.

Another market mover today was Nike. Shares of Nike (NKE) climbed 3% in after-hours trading when the clothing and apparel maker reported better than expected quarterly profit and earnings. Nike reported 3% higher quarterly adjusted earnings per share of 78 cents, beating forecasts calling for a profit of 75 cents.

Our 10 ETFs in the Spotlight went nowhere but the leading ETF for the year made a new high again…

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

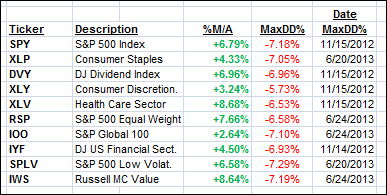

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

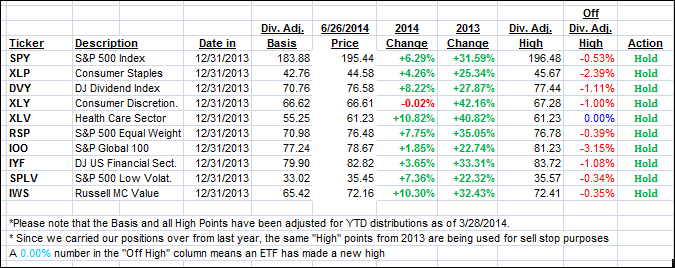

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Both Trend Tracking Indexes (TTIs) remained just about unchanged:

Domestic TTI: +3.64% (last close +3.61%)

International TTI: +3.95% (last close +3.95%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli

Comments 2

Ulli

The performance of the ETFs in the Spotilight is impressive. Do you have any suggestion on how some or all of them might be included in a portfolio? Or could they form a portfolio in themselves?

Regards

Tarentola

Tarentola,

I can’t give direct advice, since I don’t know your circumstances. You should make your selections based on your risk tolerance. Sure, you could use all of them, if you have a larger portfolio or just some of them. As a general observation, most investors diversify too much. As an example, for a $500k portfolio, I have used as few as 4 ETFs. Whatever your mode of operation, be sure to use my recommended sell stop discipline.

Ulli…