ETF/No Load Fund Tracker Newsletter For May 30, 2014

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, May 30, 2014

EQUITIES HEADING INTO UNCHARTERED TERRITORY

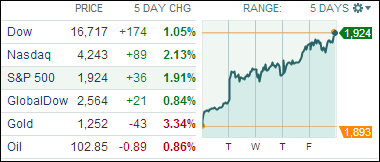

[Chart courtesy of MarketWatch.com]1. Moving The Markets

Equities had several new record highs on the week, lifting the tally to 14 new highs in the S&P 500 in 2014. For the week, all major indexes climbed as the 5-day chart above shows. The S&P 500 rose 2.1% in May, which was its fourth consecutive monthly increase. Also, all three primary U.S. stock composites are now positive for the 2014 calendar year. So, things are looking good, at least for the time being, as we head into the summer months.

Investors tuned in today to see if the positive momentum would continue or if the weak GDP report yesterday would weigh on stocks today. Although the gross domestic product data was weaker than anticipated, the primary U.S. stock composites still managed to track through positive territory throughout the last session of the month.

Overall, economic data of recent has not been a bit hard to decipher. Personal spending fell 0.1% in April, revised GDP showed the economy contracted by 1.0% in Q1. However, the consumer confidence index rose in May and durable goods orders were up 0.8%. While data is surely mixed, the sentiment amongst investors is that the economy should (slowly but surely) continue to show solid growth moving forward.

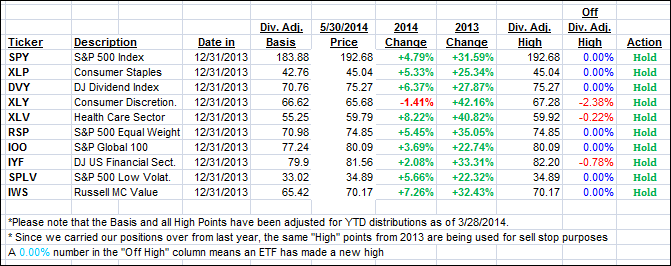

Our 10 ETFs in the Spotlight picked up some steam; 7 of them made new highs today while 9 of them remain on the plus side YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

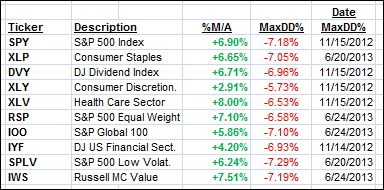

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) joined the party and rallied sharply ending the week as follows:

Domestic TTI: +3.15% (last Friday +2.09%)

International TTI: +4.21% (last Friday +3.01%)

Have a great weekend.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Adrian:

Q: Ulli: It seems that the online press has been inundating its readers with a constant barrage of market predictions along the lines of Dennis Gartman in the below piece:

He changed his mind now several times as to what the markets might do. Others are suggesting a 20% or so correction is due later on this year. What’s your take on this?

A: Adrian: I’m reading most of these wild predictions with a sense of amusement. No one really knows and, to my way of thinking, it’s not only an exercise in futility but a total waste of time. It’s so much easier to put an investment plan in place and let the long-term trends, and their changes in direction, be your guide as to when to exit and head for the safety of the sidelines.

On the other hand, if everyone would follow this type of sensible approach, there would be nothing to write about in the financial media and some publications and TV channels might cease to exist.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli