1. Moving The Markets

Stock markets will be closed tomorrow in observance of Good Friday, so today was the last day of trading for the week. The direction continued upwards with 2 out of the 3 major indexes ending on the plus side with small gains.

General Electric (GE), Morgan Stanley (MS) and PepsiCo (PEP) all moved higher today after reporting first-quarter results that topped analyst expectations. It seems that markets would have pushed even higher today had it not been for Google (GOOG) and IBM (IBM) posting disappointing figures that had a negative impact on their respective indexes. Investors are poised to remain focused on corporate earnings announcements over the next couple of weeks as less than one-fifth of S&P 500 companies having reported results so far and about 63% have topped earnings expectations. This exceeds the 56% average over the past four quarters.

We also saw the latest data today that showed the U.S. economy’s health was improving. The number of Americans filing new claims for unemployment benefits rose less than expected in the latest week and came near pre-recession levels. Also, factory activity in the U.S. mid-Atlantic region expanded in April at a faster rate than anticipated, according to a survey from the Federal Reserve Bank of Philadelphia.

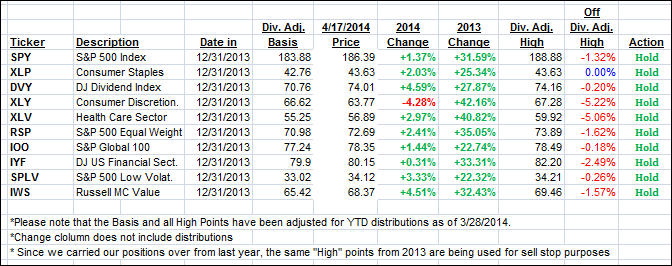

Our 10 ETFs in the Spotlight went sideways with one of them still remaining below its long term trend line; however, 1 made a new high today while 9 are now in the green YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

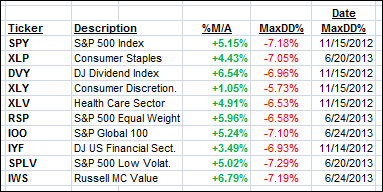

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode, with the exception of XLY, meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column. The “Action” column will signal a “Sell” once the -7.5% point is taken out in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) barely changed from yesterday’s close:

Domestic TTI: +2.26% (last close +2.31%)

International TTI: +3.20% (last close +3.08%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli