1. Moving The Markets

We received some good news regarding unemployment today. A report came in that showed the number of people who filed for unemployment benefits fell last week to the lowest level in three months. This report was one of the first bits of good news investors have received on the economy after weeks of data that showed the U.S. recovery temporarily slowing because of the severe winter. It has been somewhat hard to tell exactly what data has been directly related to the winter storms. This is not the case though with unemployment claims and the market responded positively today with the S&P 500 closing at a new record (again) and the Dow making notable gains.

Do you buy your ink cartridges in-person or online? Well, it seems that the answer is divided 50/50 amongst Staples customers. Staples (SPLS) made headlines today as it announced that it will close 10% of all of its stores due to the fact that now almost half of its sales are generated online. Staples is the second major brick-and-mortar retailer this week to announce widespread closures. Remember that two days ago I wrote about RadioShack announcing it would close as many as 1,100 locations as part of a restructuring effort.

Outside the U.S., investors remained concerned about Ukraine, where tensions have been escalating over Russia’s deployment of troops to Ukraine’s Crimea Peninsula. Moscow-backed Crimean officials said Thursday that the region would hold a referendum to decide whether it should be annexed by Russia. President Barack Obama declared that the referendum would violate international law. I would not be surprised to see continued volatility in the markets as this situation remains unstable.

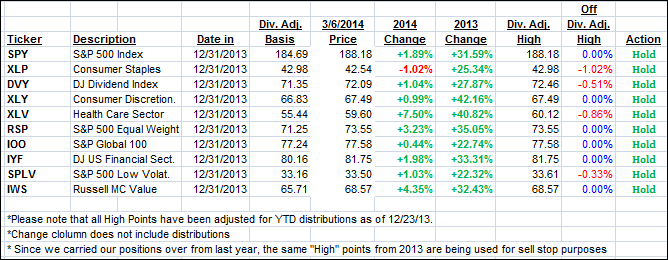

Our 10 ETFs in the Spotlight vacillated with 6 of them making new highs while 9 of them have now moved to the plus side YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

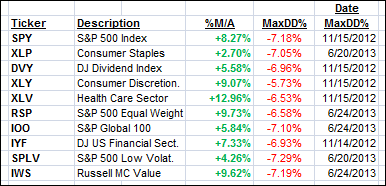

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) were mixed today with the Domestic one remaining unchanged while the International one rallied:

Domestic TTI: +4.69% (last close +4.69%)

International TTI: +6.71% (last close +6.14%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli