1. Moving The Markets

U.S. stocks took a tumble today, with the Nasdaq realizing its biggest daily percentage drop since early February, as some of the market’s recent best performers like technology and biotech shares led the way down. Weakness in the health care sector (XLV) also dragged the U.S. stock market lower. Pharmaceuticals got spanked again, and we got stopped out of our holdings in PJP as its momentum weakend considerably over the past 30 days.

The S&P 500 index fell 0.5%, the Dow lost 0.2% and the tech focused Nasdaq composite fell 1.2%. Almost 80 percent of the stocks traded on the Nasdaq were lower, while about two-thirds of New York Stock Exchange-listed shares fell. Eight of the 10 S&P 500 sectors slid for the day.

In stocks, Netflix, Inc. (NFLX) dropped $6.67 to $378.90 on potential competition from Apple Inc. (AAPL). The Wall Street Journal reported that the iPhone and iPad maker is in talks with Comcast Corporation (CMCSA) to release a TV set-top box. The stock price of Apple gained 1.19% to $539.19 per share while Comcast rose 0.60% to $50.30 per share today. Herbalife Ltd (HLF) said it would allow three more representatives of billionaire investor Carl Icahn, the company’s biggest shareholder, to join its board. Shares of the nutrition and weight-loss company jumped 7.7 percent to $53.35.

In the latest snapshot of the US economy, financial data firm Markit said its preliminary read on March manufacturing activity slowed after nearing a four-year high last month. Markit, however, said the rate of growth and the pace of hiring remained strong.

Ukraine announced the evacuation of its troops from Crimea, essentially yielding the region to Russian forces, which seized a Ukrainian marine base. While few US companies have excessive exposure to the region, investors are concerned about the potential economic fallout from any escalation in tensions.

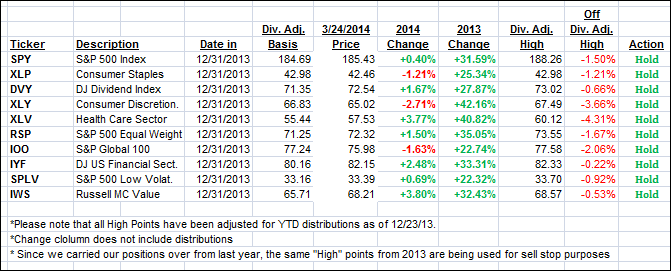

Our 10 ETFs in the Spotlight slipped with 7 of them remaining on the plus side YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

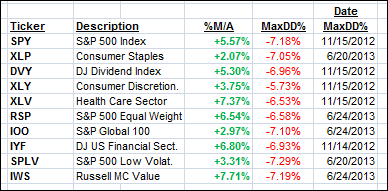

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) followed the major indexes south and closed this volatile day on a weak note:

Domestic TTI: +2.87% (last close +3.24%)

International TTI: +2.61% (last close +2.96%)

Have a great week.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli