1. Moving The Markets

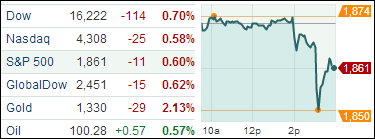

Investors weren’t too thrilled by what they heard from Janet Yellen during her first meeting in charge of the Fed. U.S. stock markets backed off today amid worries that the U.S. Federal Reserve could end up raising interest rates as soon as the spring of next year. The greenback and U.S. Treasury yields appreciated sharply after the Fed announcement while the major indexes dropped as the chart above shows.

Worries about China have sent copper prices reeling, falling more than 7% since March 6 in the wake of tepid economic data, while the base metals sector has dropped well over 6% this month. Deutsche Bank said earlier this week that heightened market volatility in the Chinese RMB currency market, alongside China’s first domestic bond default, have sparked market fears that commodity financing deals in China could unravel. Such an event has the potential to also result in widespread metals liquidation. Optimism that the Ukraine crisis won’t worsen pushed gold prices down $17.70 to $1,341.30, sending the gold sector about three per cent lower.

In corporate news, JPMorgan Chase (JPM) sold its physical commodities business for $3.5 billion, after new regulations crimped its ability to control power plants, warehouses, and oil refineries.

Our 10 ETFs in the Spotlight headed south as well with 7 of them still remaining on the plus side YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

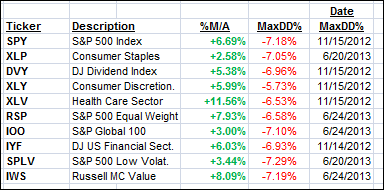

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

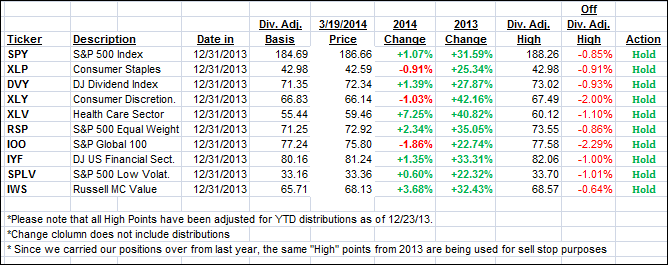

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped following the Fed accouncement and closed as follows:

Domestic TTI: +3.50% (last close +4.20%)

International TTI: +3.65% (last close +4.50%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli