ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, March 21, 2014

EQUITY INDEXES LOSE STEAM BUT GAIN FOR THE WEEK

[Chart courtesy of MarketWatch.com]1. Moving The Markets

Equities were bouncing back this week but metals aren’t keeping up. More important is Janet Yellen’s statement indicating that interest rates could rise sooner than expected. The unemployment rate, though manipulated, is still higher than what the FED would regard as ‘full employment.’

The big news item for the week was Wednesday’s announcement by newly appointed Federal Reserve chair Janet Yellen indicating that interest rates could go up sooner than previously expected. While Wall Street had been anticipating the Fed to raise rates for quite some time, the ambiguous manner in which Yellen addressed the issue sent stocks and bonds tumbling. Adding to the vagueness were other mitigating factors that could play into the Fed’s decision making process, namely the unemployment rate which currently stands at 6.7 percent, well above the 5.2 to 5.6 percent range Fed officials see as in keeping with full employment.

Domestic markets aren’t quite in the same Q1 stride as we experienced in 2013. In the first quarter 2013, advancing days exceeded declining days by nearly 61%. For 2014, that ratio is down to 16%, and with only 7 more sessions remaining for the current quarter, there’s not much room for improvement. That means it’s important to have your sell stop discipline in place in case momentum goes the other way, and the markets decide to head south.

Geopolitical issues remained in focus this week after President Vladimir V. Putin signed laws completing Russia’s annexation of Crimea and investors were unnerved by a decision by the United States to slap sanctions on his inner circle. Russia’s MICEX stock index was down 1 percent.

Gold and the rest of the precious metals complex has been taking some hard hits this week, scaring off would-be investors from diverting capital into the traditional safe-haven asset. While the yellow metal is down below a key support level of $1,350, it is also up 9% for the quarter, a performance that is 6-times that of the aforementioned large-cap equities sector.

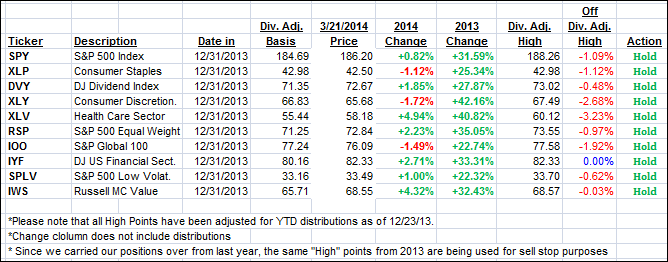

Our 10 ETFs in the Spotlight edged higher with 1 of them making a new high today while 7 of them are remaining on the plus side YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

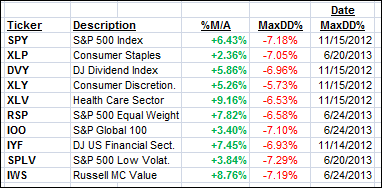

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) slipped and ended the week as follows:

Domestic TTI: +3.24% (last Friday +3.34%)

International TTI: +2.96% (last Friday +3.10%)

Have a great week.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader Duffy:

Q: Ulli: Regarding %M/A is there a % that is higher than you are comfortable with, i.e. XLV is 11.89% above its trend line, so would one think it would come down some, to an average % range above the trend. In other words, is there more risk (even though it is a buy) the higher the (%m/a) is? Do some of these ETFs have a range they are usually above the trend line?

A: Duffy: The %M/A shows me how strong the upward momentum is for a fund like XLV (which I own) compared to others. Strong momentum also means that this ETF has risen higher above its long term trend line than most of the other ETFs in the Spotlight. There is no average range that I have found that might give you a better entry point.

So, if you enter now, apply the trailing sell stop discipline rather than waiting for XLV to break below its long-term trend line. If the markets head south, and take XLV with it, I would sell it after it has come 7.5% off its high, as shown in the daily update. That gives me a better handle on controlling downside risk.

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

———————————————————

Back issues of the ETF/No Load Fund Tracker are available on the web at:

https://theetfbully.com/newsletter-archives/

Contact Ulli

Comments 3

Dear Ulli, Good morning.You are doing a great service. If easily possible, it will be very helpfull to give YTD return.ie avg of all these sectors.

Thanks,

Maghar

Maghar,

Hmmm, I am not sure which sectors you are referring to. Please review Thursday’s StatSheet for more details.

Ulli…

I am talking about avg of all ten ETFs in the table. SPY, XLP, XLV and so on. The avg would give YTD performance.

Thanks,

M Chana