ETF/No Load Fund Tracker Newsletter For March 7, 2014

ETF/No Load Fund Tracker StatSheet

————————————————————-

THE LINK TO OUR CURRENT ETF/MUTUAL FUND STATSHEET IS:

————————————————————

Market Commentary

Friday, March 7, 2014

WEEKLY RECAP; PAYROLL REPORT KEEPS MARKETS STABLE

[Chart courtesy of MarketWatch.com]1. Moving The Markets

The S&P 500 continued its climb today to close at another all-time high, still feeding off the favorable jobs reports that were released this week. The official monthly payroll report that was published today helped markets rally in early trading. Employers added 175,000 jobs in February, well in excess of the past two months and more than many observers had anticipated. The unemployment rate ticked up to 6.7%, but the increase was due mostly to a healthy rise in the labor force.

Let’s recap what happened this week. Stocks overcame a sharp pullback in response to a growing crisis in Ukraine and ended the week higher. After a sell-off on Monday, the Standard & Poor’s 500 Stock Index moved back into record territory on Tuesday and held onto its gain through much of the rest of the week.

The movement of Russian troops into Ukraine’s Crimea over the weekend rattled the world markets on Monday. Many investors moved to safer assets, and the stock market suffered as a result. Russia is a major supplier of oil and gas to Europe, and the prospect of sanctions or other disruptions sent the price of both commodities up sharply. Stock prices rallied on Tuesday, however, as Russian President Vladimir Putin seemed to indicate that Russia did not intend to annex Crimea and had no immediate plans for military action.

Emerging markets debt posted good returns when tensions between Russia and Ukraine began to subside. Investors closely watched China’s bond market, where a solar-equipment company missed an interest payment on Friday. This was the first time that the Chinese government has allowed an onshore, local-currency bond to default, and will likely cause investors to more accurately price credit risk in Chinese corporate bonds.

On the currency front, the U.S. dollar was weaker against the major currencies for the week.

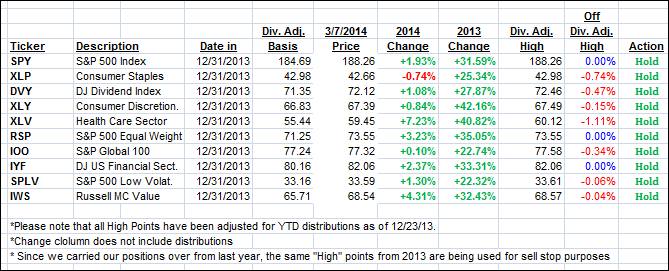

Our 10 ETFs in the Spotlight edged higher for the week with 3 of them making new highs today while 9 of them are now showing gains YTD.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

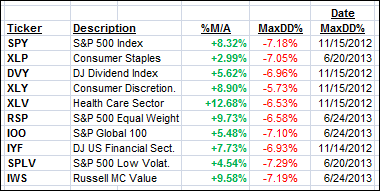

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Year to date, here’s how the above candidates have fared so far:

To be clear, the first table above shows the position of the various ETFs in relation to their respective long term trend lines (%M/A), while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) improved from last week’s close and ended as follows:

Domestic TTI: +4.35% (last Friday +4.34%)

International TTI: +6.04% (last Friday +6.39%)

Have a great week.

Ulli…

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

————————————————————-

READER Q & A FOR THE WEEK

All Reader Q & A’s are listed at our web site!

Check it out at:

http://www.successful-investment.com/q&a.php

A note from reader James:

Q: Ulli: What has happened to your 7 model portfolios? Have you abandoned this approach? Did I miss something?

A: James: Yes, you must have missed the announcement. This is what I posted in November about the discontinuation of the model portfolios as they have been replaced by the daily update of the 10 ETFs in the Spotlight:

———————————————————-

WOULD YOU LIKE TO HAVE YOUR INVESTMENTS PROFESSIONALLY MANAGED?

Do you have the time to follow our investment plans yourself? If you are a busy professional who would like to have his portfolio managed using our methodology, please contact me directly or get more details at:

https://theetfbully.com/personal-investment-management/

Contact Ulli