1. Moving The Markets

The U.S. stock market ended the day higher after suffering one of its largest declines in more than seven months yesterday. All major indexes gained as the chart above shows

Consumer and financial stocks lead the board for gains today on the S&P 500. Michael Kors (KORS) jumped up 17% on the day after the fashion giant announced 2013 Q3 earnings that far exceeded expectations. Last year’s holiday season boded well for the company as its reported $1 billion 2013 Q3 earnings marked a 59% year-over-year increase.

Also making headlines today was the news that Microsoft ended their 5-month search for a CEO as they assigned Satya Nadella the role. Mr. Nadella was the head of the company’s cloud computing division and enterprise business.

An interesting bit of news surfaced today regarding Coffee. As you may know, 2013 was a tough year for commodities in general due to the equity bull market. Coffee was one of many commodities that suffered. However, things may be looking up for Coffee investors because it was reported today that Brazil, the world’s top coffee producer, has been experiencing a severe drought over the past couple of months just ahead of its annual dry season which begins in April. A lack of water may reduce supply, increase demand and thus market price.

So, it may be interesting to keep an eye on two ETFs that invest in the coffee market, iPath Dow Jones UBS Coffee ETN (JO) and iPath Pure Beta Coffee ETN (CAFE), in which we have no holdings.

Our 10 ETFs in the Spotlight recovered but 3 of them are still hovering below their respective trend lines.

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

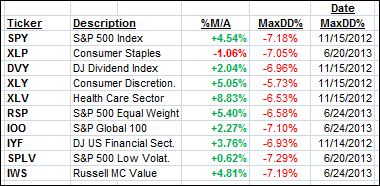

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

7 of them remain in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

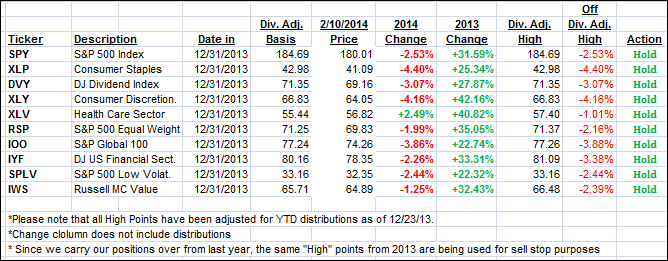

Year to date, here’s how the above candidates have fared so far:

Keep in mind that the first table above strictly shows the position of the various ETFs in relation to their respective long term trend lines (%M/A) while the second one tracks their trailing sell stops in the “Off High” column.

3. Domestic Trend Tracking Indexes (TTIs)

Our Trend Tracking Indexes (TTIs) recovered from yesterdays lows and remain on the bullish side of their respective trend lines:

Domestic TTI: +1.45% (last close +1.15%)

International TTI: +1.70% (last close +1.36%)

Contact Ulli