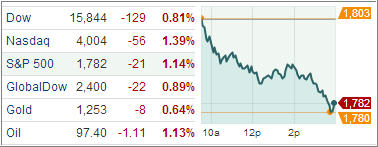

1. Moving The Markets

Domestic Equities posted their largest drop in a month, with traders locking in recent gains after a provisional budget deal out of Washington. The bipartisan budget agreement reached late Tuesday would end three years of political confrontations and fiscal instability in Washington. The final Fed policy statement of the year is expected on December 18, at the end of a two-day meeting. It seems as we head toward the end of FY2013 that people are more concerned about locking in profits in positions that have had big gains this year.

In one of the few items of market-moving news on Wednesday, Costco’s (COST.O) profit missed Wall Street’s estimates because of higher stock-based compensation expenses and spending on technology. Its shares fell 1.2 percent to close at $118.57.

The euro rose for a seventh straight session against the dollar on Wednesday, driven by higher money market rates and a growing belief that the European Central Bank will keep interest rates low for some time but not cut them. The euro is at a six-week high and within striking distance of its best level versus the dollar in over two years. However, the euro zone still faces a long road to recovery, given the recent weak economic data, particularly in France.

ETF’s ended mostly in the red today with only Consumer Staples bucking the trend and showing gains of 0.16%. Facebook will join the S&P 500 on Dec. 20th. Facebook’s entry into the S&P 500 means the stocks will soon be found in some of the largest ETFs, including the largest in the world, the $166.1 billion SPDR S&P 500 (SPY) and the $51.2 billion iShares Core S&P 500 ETF (IVV).

All of our ETFs in the Spotlight slipped with the exception of Consumer Staples (XLP), which closed on the plus side:

2. ETFs in the Spotlight

In case you missed the announcement and description of this section, you can read it here again.

It features 10 broadly diversified ETFs from my HighVolume list as posted every Monday. Furthermore, they are screened for the lowest MaxDD% number meaning they have been showing better resistance to temporary sell offs than all others over the past year.

In other words, none of them ever triggered their 7.5% sell stop level during this time period, which included a variety of severe market pullbacks but no move into outright bear market territory.

Here are the 10 candidates:

All of them are in “buy” mode meaning their prices are above their respective long term trend lines by the percentage indicated (%M/A).

Now let’s look at the MaxDD% column and review the ETF with the lowest drawdown as an example. As you can see, that would be XLY with the lowest MaxDD% number of -5.73%, which occurred on 11/15/2012.

The recent sell off in the month of June did not affect XLY at all as its “worst” MaxDD% of -5.73% still stands since the November 2012 sell off.

A quick glance at the last column showing the date of occurrences confirms that five of these ETFs had their worst drawdown in November 2012, while the other five were affected by the June 2013 swoon, however, none of them dipped below their -7.5% sell stop.

Year to date, here’s how the above candidates have fared so far:

3. Domestic Trend Tracking Indexes (TTIs)

Trend wise, our Trend Tracking Indexes (TTIs) headed south but remain on the bullish side of their respective long-term trend lines:

Domestic TTI: +3.65% (last close +4.30%)

International TTI: +5.21% (last close +6.03%)

Disclosure: I am obliged to inform you that I, as well as advisory clients of mine, own some of these listed ETFs. Furthermore, they do not represent a specific investment recommendation for you, they merely show which ETFs from the universe I track are falling within the guidelines specified.

Contact Ulli