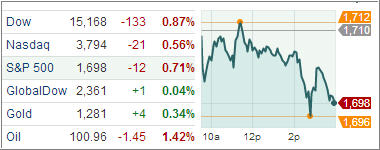

U.S. equity markets finished near their lows in a volatile session following a four day rally in the Standard & Poor’s 500 Index, as yesterday’s optimism that a deal among U.S. lawmakers was close seemed to slip away in the wake of continued bickering among the political parties that have stalled the talks.

After the market closed, futures indicated continued pressure after Fitch placed the United States’ AAA rating on rating watch negative, citing the debt ceiling gridlock.

Markets displayed modest losses at the open, but were able to turn positive by late afternoon. The rebound was based on optimism associated with the budget jawboning in Washington. However, selling pressure intensified during the final 90 minutes of the session amid indication that the Senate has halted its negotiations pending the outcome of the House vote.

All ten sessions ended in the red with countercyclical consumer staples (-0.9%) and utilities (-1.4%) leading the downside. Among staple stocks, Coca-Cola lost 0.7% following its in-line earnings report.

Also of note, the financial sector (-0.8%) underperformed the broader market after Citigroup reported a 7.8% year-over-year decline in revenue. Meanwhile, crude oil fell 1.3% to $101.08 a barrel and gold futures added 0.3%.

Treasuries ended near their lows. More notably, short-term debt was pressured with traders dumping the paper amid increased probability of a default. Elsewhere on the economic front, today’s data showed a slow down in manufacturing growth in the New York Fed region as the Empire Manufacturing Survey for October registered a reading of 1.5, compared to 6.3 last month while economists expected the survey to slide to 4.5.

Our Trend Tracking Indexes (TTIs) followed the major index ETFs and slipped to +2.78% and +6.33% for the Domestic TTI and International TTI respectively.

Contact Ulli