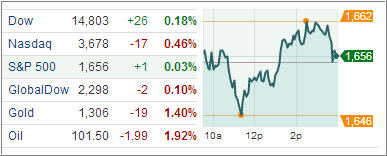

Domestic equities bounced off of session lows, rebounding from the benchmark index’s biggest two-day slump since June, with the Dow and S&P 500 gaining modest ground while the Nasdaq finished lower for a third day, pressured as investors sold this year’s winning tech stocks including Netflix and Fastenal. Traders were skeptically optimistic following the nomination of Federal Reserve Vice Chair Janet Yellen for Fed Chairman and news that President Obama will meet with lawmakers on Thursday to discuss the debt ceiling and budget impasse, now in its ninth day.

Equities began the session with slim gains, however, given the expected nature of the Fed Chairman announcement, the early boost faded quickly. The major averages appeared on their way to another losing session, but found support during late-morning trade when the Dow Jones Industrial Average tested its 200-day moving average (14,728) for the first time this year.

On a related note, the financial sector (+0.3%) finished ahead of the remaining cyclical groups while other growth-sensitive areas were a bit more mixed. On the downside, the discretionary sector (-0.4%) lagged throughout the session as quick service restaurants displayed weakness after Yum! Brands reported disappointing earnings and made cautious comments about its operating environment going forward.

Elsewhere, much of the Nasdaq under performance was the result of significant losses among biotechnology. The iShares Nasdaq Biotechnology ETF lost 2.1% to extend its week-to-date loss to 8.5%. In turn, this weighed on the health care sector (-0.2%), which was the only counter cyclical group ending in negative territory.

On economics front, Fed minutes highlighted fiscal policy uncertainty. Treasuries were mixed following the release of the minutes from the Federal Reserve’s September policy meeting showing officials continue to be divided on when to begin to wind down the asset purchase program, while domestic mortgage applications rose modestly.

Meanwhile, Yellen, an advocate for aggressive action to stimulate U.S. economic growth through low interest rates and large-scale bond purchases, would succeed Fed chairman Ben Bernanke, whose second term ends on January 31. A poll by Reuters showed Wall Street strategists expect the market to rebound towards the end of the year.

Our Trend Tracking Indexes (TTIs) slipped a bit closing this roller coaster day with +1.71% (Domestic TTI) and +4.51% (International TTI).

Contact Ulli