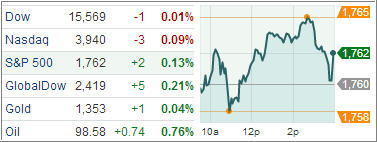

The U.S. markets finished mixed and near the flatline, as traders look toward a barrage of earnings and economic data this week, headlined by the Fed’s monetary policy decision on Wednesday.

The S&P 500 closed at another record high on Monday as expectations were high that the Fed will keep its stimulus in place when it meets this week. Meanwhile, the markets got a taste of the slew of economic data that was postponed as a result of the government shutdown, with industrial production and capacity utilization topping forecasts, while pending home sales unexpectedly fell and growth in regional manufacturing activity slowed more than expected.

On the earnings front, Dow member Merck & Co bested the Street’s profit expectations but fell short on the revenue side, while Burger King Worldwide topped estimates and upped its quarterly dividend. In other equity news, Dow component JPMorgan Chase & Co reached a $5.1 billion agreement to resolve all of its mortgage-backed securities litigation with the Federal Housing Finance Agency. Treasuries and the U.S. dollar finished nearly unchanged, while gold and crude oil prices were higher.

Stocks alternated between gains and losses through the first two hours of action before the S&P climbed to a fresh record high of 1764.99. Final-hour selling cut the S&P’s gain in half, but the index still finished ahead of the Dow and the tech-heavy Nasdaq (-0.1%), which was challenged by its flat line throughout the session.

Although the third-quarter earnings season is far from being over, today featured just a handful of notable reports. Health care components caught the eye of some participants with Biogen reporting solid results and Bristol-Myers Squibb announcing positive clinical trial data. Generally speaking, countercyclical sectors followed in health care’s lead as consumer staples (+1.2%) and telecom services (+0.4%) outperformed while utilities (-0.2%) lagged.

Meanwhile, cyclical groups were a bit more mixed. Energy (+0.1%) and technology (+0.3%) finished in positive territory while consumer discretionary (-0.2%), financials (-0.2%), industrials (-0.1%), and materials (-0.6%) trailed the S&P. The technology sector ended among the leaders.

Our Trend Tracking Indexes (TTIs) barely changed with the Domestic TTI closing at +5.04% while the International TTI ended the day at +8.44%.

Contact Ulli