U.S. equities fell on Monday, extending two weeks of losses, amid the continued stalemate in Washington over a budget for the fiscal year, exacerbated by concerns surrounding the looming debt ceiling deadline.

It was a poor start to the week for the equity market and the same thing could be said for politics in Washington. The S&P 500 ended near its lows of the session in a volatile day and dropped for its 10th time in the past 13 sessions. Not surprisingly, volume was on the light side today as the incentive to participate was taken away by Washington’s woes.

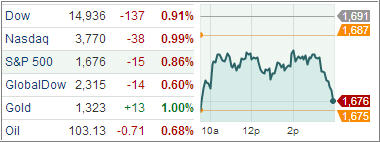

An absence of buyers paved a path to a sizable decline when the opening bell rang. Shortly after the start of trading, the Dow, Nasdaq, and S&P 500 dropped 152, 34, and 16 points, respectively. That lower level soon attracted some buying interest, and the opening losses were eventually cut in half, but the rebound effort ran out of steam. Analysts estimated that each week the shutdown continues it could shave 10 to 15 basis points off gross domestic product.

The only sector to escape today’s weakness was the telecom services sector (+0.6%). All other sectors traded lower with the growth-sensitive cyclical sectors bearing the brunt of the selling pressure. The consumer discretionary (-1.4%), financial (-1.2%), and materials (-1.2%) sectors were the biggest losers.

Meanwhile, treasuries finished higher as the partial U.S. government shutdown enters its second week, while a read on consumer credit in the final hour of trading did little to sway sentiment. With the ongoing stalemate in Washington, trade data on Tuesday and retail sales on Friday are among important economic reports that will not be released if the shutdown continues. Last week, non-farm payrolls, construction spending, and factory orders data were not published.

European and Asian equity markets finished mostly lower, with conviction continuing to be stymied by the continued government shutdown and uneasiness regarding the debt ceiling debate in the U.S. Meanwhile, a report showed Eurozone investor sentiment unexpectedly declined for October. In economic news out of the Asia Pacific region, Japan’s Leading Index declined slightly more than economists had expected in August.

It’s no surprise that our Trend Tracking Indexes (TTIs) headed lower as well with the Domestic TTI closing at +2.60% while the International TTI ended this volatile day at +5.61%.

Contact Ulli