U.S. equities extended yesterday’s solid losses as a gauge of Wall Street anxiety hit its highest level in more than three months with equity markets showing growing concern over no indication of progress from lawmakers on budget and debt ceiling negotiations.

A disappointing debt auction of one-month Treasury bills, which saw the rate almost triple the borrowing costs seen last week, added fuel to the fire, as Treasuries finished mostly lower, with the short-end of the curve seeing the brunt of the pressure amid the fiscal stalemate. Moreover, the government shutdown continues to impede on investors getting pertinent economic data, with the only item on the docket showing a slight decline in business sentiment.

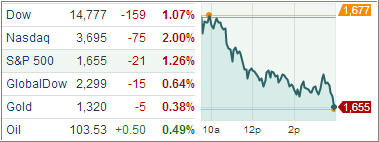

Traders cashed in gains in some of the year’s best performers. The Nasdaq Composite was the biggest loser today, sliding 2.0%. The cracks in leading names like LinkedIn, Priceline.com, Yahoo and Facebook provided an added cue for buyers to stick mostly to the sidelines. An index of Internet stocks tumbled the most in almost two years, sinking 4.1 percent.

The major indices finished at their lows for the day as a final wave of selling interest in the last ten minutes completed today’s damage. The utilities (+0.6%) sector was the only sector in the S&P 500 to finish in positive territory. Wal-Mart, Procter & Gamble, and Coca-Cola were the only Dow components to finish higher. That helped the Dow Jones Industrial Average show some relative strength versus its counterparts, most of which fell between 1.2% and 2.0%.

It was only fitting perhaps that the low beta sector outperformed as high beta stocks got hit hard. Longer-dated Treasuries and gold prices ended with modest losses while the U.S. Dollar Index was little changed to the upside. In terms of the Treasury market, the real point of interest was at the front end of the curve. The 4-week bill surged nearly 14 basis points to 0.29% as traders remained leary of the paper with the October 17 debt limit deadline on the near horizon. The 4-week yield is at its highest level since October 2008.

On economics news, small business optimism unexpectedly dipped. The NFIB said the largest contributing factor to the dip was the “significant increase in pessimism about future business conditions.”

Although a lack of data is adding to the issues of the markets, tomorrow’s US economic calendar will yield a piece of data that is likely to garner attention, in the form of the minutes from the last Federal Open Market Committee (FOMC) meeting. The Fed surprised the markets by not tapering its asset purchases in the September meeting, while also citing concerns about the impact of tighter fiscal policy on the economy.

Needless to say, our Trend Tracking Indexes (TTIs) followed downward momentum and closed as follows:

Domestic TTI: +1.85%

International TTI: +4.66%

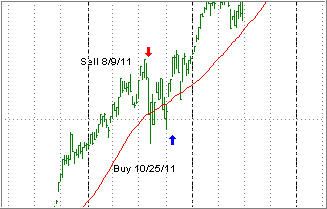

The open ended question remains as to whether the circus in Washington will continue without a nearterm resolution. If so, we may see a trend line break generating an allout sell signal. If subsequently cooler heads prevail and a budget/debt ceiling agreement is reached, this signal may only be ephemeral in nature similarily to what we saw in 2011:

In any event, we are prepared to execute our sell stop strategy, should the need arise.

Contact Ulli