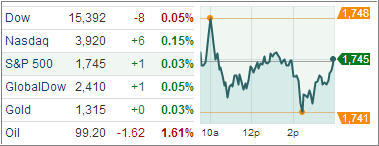

U.S. equities finished mixed and near the flatline in a choppy session, as investors await a week chock full of earnings and economic data, headlined by tomorrow’s release of the September nonfarm payroll report.

Meanwhile, the Dow was pressured by McDonald’s disappointing same-store sales and lackluster guidance which overshadowed its better-than-expected 3Q earnings. In other equity news, Dow member JPMorgan Chase & Co reportedly reached a $13 billion civil settlement with the U.S. government, fellow Dow component AT&T agreed to sell or lease 9,700 wireless towers to Crown Castle International for $4.85 billion in cash, RadioShack reportedly secured new financing, and Netflix posted better-than-expected 3Q results after the close.

Elsewhere, treasuries were lower following a decline in U.S. existing home sales, while gold and crude oil prices were lower, and the U.S. dollar was flat.

The outperformance of the Nasdaq resulted from the relative strength of the technology sector (+0.5%), which was the leading cyclical group of the session. Apple accounted for much of the tech sector’s gain while other large components were mixed. Microsoft added 0.1% while IBM remained under pressure following its earnings miss last Thursday.

Elsewhere, the industrial sector (+0.4%) outperformed with its top member, General Electric, making a significant contribution after UBS raised its target for the stock to $29 and Citigroup added the stock to its U.S. Focus List. Transports also displayed relative strength as the Dow Jones Transportation Average added 0.4%.

The discretionary sector was the last cyclical group to climb into positive territory after several components reported earnings. Even though three influential sectors posted gains, the broader market was pressured by the underperformance of energy (-0.4%) and financials (-0.2%). In addition, three countercyclical sectors-consumer staples (-0.3%), health care (-0.6%), and utilities (-0.2%)-also weighed while telecom services (+1.2%) outperformed.

Though only a small percentage of S&P 500 stocks have reported earnings thus far, the season has been mixed, with revenue growth especially a concern. Still, profits have largely risen and many bellwether companies have topped expectations.

With 21 percent of S&P companies having reported, 61.5 percent have topped profit expectations, a rate slightly above the historical average. But only 52 percent have topped expectations on revenue, below the historical average of 61 percent.

Meanwhile, existing homes sales dipped as economic calendar plays catch up. Sales fell 1.9% month-over-month in September to an annual rate of 5.29 million, after hitting a four-year high in August, slightly below the 5.30 million unit estimate.

Trend wise, not much changed in today’s sideways session. The Domestic TTI closed at +4.50% while the International TTI ended up at +8.35%.

Contact Ulli