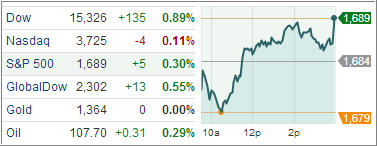

The Dow and S&P 500 Index continued their recent upward drive, amidst easing concerns over possible U.S.-led military action against Syria, while the Nasdaq closed lower as Apple Inc’s biggest decline since April weighed on the index.

The Standard & Poor’s 500 Index advanced to a one-month high, the seventh straight winning session. Market nervousness abated as U.S. President Obama asked congressional leaders to delay a vote on authorizing military force to give the diplomatic efforts a chance. That has lessened some of the macro concerns out there as investors are rotating back towards the market.

In economic news, wholesale inventories rose 0.1% month-over-month in July, snapping a three month streak of declines, compared to the 0.3% growth forecasted by economists. Elsewhere, the MBA Mortgage Application Index fell 13.5% last week, after the index increased in the previous week. This drop came as a 28% tumble for the Refinance Index was accompanied by a 2.7% decline for the Purchase Index. The average 30-year mortgage rate rose 7 basis points (bps) to 4.80%.

Treasuries traded higher following the reports. The domestic economic docket for tomorrow will yield the releases of the weekly initial jobless claims and the Import Price Index.

The key indices diverged at the open with the tech-heavy Nasdaq and S&P 500 starting in negative territory due to significant weakness in the largest tech stock. Apple sank 5.4% after a plethora of analyst downgrades of the company followed the company’s overnight product refresh event in China did not reveal a deal with China Mobile as many investors had expected.

The underperformance of Apple kept the Nasdaq and the technology sector (-0.5%) in the red throughout the day while the S&P was able to shake off the opening weakness. Rotten price action in the shares of Apple masked the solid gains in many other large tech names.

Outside of technology, the financial sector (+0.1%) was the only cyclical group that trailed behind the S&P. The broader market was kept afloat by the relative strength of the remaining growth-sensitive sectors.

Energy, industrials, materials, and discretionary shares gained between 0.5% and 0.8% with energy and materials in the lead. The other commodity-related space, materials, tacked on 0.6%. Gold miners contributed to the relative strength as the Market Vectors Gold Miners ETF climbed 0.8%. Countercyclical sectors have been a bit shaky in recent days, but ended today’s session in mixed fashion. Consumer staples (+0.8%) and health care (+0.7%) outperformed while telecom services and utilities (-0.9%) lagged.

Our Trend Tracking Indexes (TTIs) followed the S&P higher with the Domestic TTI ending at +2.39%. The International TTI closed the day at +6.59%.

Contact Ulli