The U.S. Federal Reserve was back in the spotlight again as traders worried that the Fed would begin to scale back its monetary stimulus when it meets on Tuesday and Wednesday next week. U.S. equity averages fell, halting a seven-day win streak for the Standard & Poor’s 500 Index as materials producers slid amid growing concern over Syria.

Economic data showed first-time weekly claims for state unemployment benefits, the last major reading on the labor market before the Fed’s meeting, fell to the lowest level since 2006, but the picture was incomplete because two states did not process all their claims.

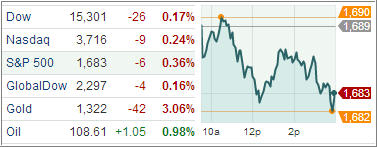

Nine of ten S&P 500 industry sectors ended in the red. After posting gains in each of the past seven sessions, several of this month’s top performers fell victim to some profit-taking. Financials, industrials, and materials led to the downside with losses ranging between 0.5% and 1.0%. The financial sector was pressured by the underperformance of most large banks as investors attempted to gauge the impact of a slowdown in the mortgage industry.

Although oil settled higher, the rest of the commodity complex did not fare nearly as well. Miners and steelmakers lagged as the Market Vectors Gold Miners ETF fell 5.6% and the Market Vectors Steel ETF lost 1.2%. The materials sector rounded out the bottom of today’s leaderboard with its loss of 1.0%.

While most cyclical sectors trailed behind the broader market, discretionary shares (-0.2%) and technology (-0.1%) outperformed. The discretionary space finished ahead of the S&P with help from media companies. Countercyclical sectors ended mixed as the telecom services space added 1.0% while consumer staples, health care, and utilities lost between 0.2% and 0.3%.

Besides the unemployment benefits report, early afternoon headlines from Washington reminded participants that the U.S. budget situation remains far from solved. House Speaker John Boehner said that spending reforms must be implemented in order to increase the debt ceiling. The Speaker also commented on Syria, saying that he has doubts about the plan to put Syria’s chemical weapons under international control.

Our Trend Tracking Indexes (TTIs) pulled back slightly with the Domestic TTI ending the day at +2.27% while the International TTI settled at +6.34%.

Contact Ulli