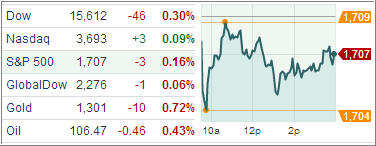

Despite favorable services sector activity reports from China and the U.S., as well as an upward revision to Eurozone business activity data, U.S. equity markets fell from record highs Monday to kick off the week. About 4.6 billion shares changed hands on the New York Stock Exchange, the Nasdaq and NYSE MKT, the lowest for a full day of trading so far this year.

The earnings season is winding down sharply after last week’s deluge. This week is also thin in terms of market-moving macroeconomic data, leaving the market directionless as you could see by today’s session.

On economic front, the ISM Non-Manufacturing Index improved more than expected in July, rising to 56.0—the highest since February—from 52.2 in June, while the expectation of economists called for an increase to 53.1, with a reading of 50 separating expansion from contraction. The report is considered a measure of the service sector, which accounts for a majority of U.S. economic activity and is the companion to the ISM Manufacturing Index, which hit the highest level since June 2011 last week.

The economy seems to be allegedly getting stronger, with the auto industry continuing to be strong and expected to be throughout 2013, despite increased commodity prices. But the healthcare sector, which reported a contraction, pointed out that the sequestration and healthcare reform are causing uncertainty and lower revenues.

Oversea, the Eurozone PMI Composite Index was revised higher to 50.5 in July. This was the first time the index moved above the key 50 level that depicts expansion since January 2012, up from the 48.7 posted in June.

However, the upbeat business activity report was countered by a disappointing profit report from HSBC Holdings, which traded solidly lower after Europe’s largest bank posted earnings that missed analysts’ expectations. In China, the Non-Manufacturing PMI rose to 54.1 from 53.9 while Great Britain’s Services PMI posted its best reading since 2006, rising to 60.2 from 56.9. Surprisingly, U.S. stocks slipped out of the gate early.

Technology sector tacked on 0.2%. Outside of technology, only the consumer staples sector (+0.1%) managed to eke out an advance. While the outperformance of technology boosted the Nasdaq, the S&P was kept from turning positive as energy, industrials, and discretionary shares weighed.

Elsewhere, industrials lagged amid weakness in transportation companies. Lastly, broad weakness among home builders pressured the discretionary sector.

Our Trend Tracking Indexes (TTIs) only budged slightly with the Domestic TTI ending the day at +3.82% while the International TTI closed at +7.38%.

Contact Ulli

Comments 2

Ulli: Your advice on stops 7% equities and the formula to calculate seems straight forward. On 8/2/13, DVY hit yet another new high – $68.53 . Dividends per share total $3.22. I subtracted the dividends from that high resulting in a price of $65.31. I then subtract the 7% resulting in a suggested stop of $60.74 ,

It closed at $68.30 on 8/5. Am I understanding correctly that if no new highs occur or dividends are paid, the ETF must fall to $60.74 or more which is $7.56 below where it currently trades, about 12% less than what it is now?

Thank you

John,

The short answer is yes and know. You have it almost correct. You deduct the dividends only from the high price for the period that you actually owned DVY. In other words, had you bought DVY on June 26, 2013, and DVY makes its high as you said on 8/2/13 at 68.53, then you calculate the 7% from this value of 68.53, since no dividends have been paid since June 26, 2013. Dividends prior to your purchase are irrelevant.

Ulli…