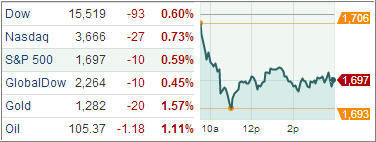

U.S. equity ETFs slid for a second consecutive day amid a plethora of mediocre earnings reports on both sides of the pond, despite the U.S. trade balance narrowing to its smallest deficit since October 2009. Adding to the negative atmosphere on the markets were comments from a pair of U.S. Federal Reserve officials fueling concern the Federal Reserve may reduce its bond purchases this year. All ten sectors of the S&P 500 Index registered losses.

Cyclical sectors pressured the index below the 1,700 level with financials, materials, and industrials leading to the downside. All top-weighted banks ended in the red while the broader sector slid 0.9%. Elsewhere, materials finished at the bottom of the leaderboard as steelmakers, gold miners, and chemical producers displayed broad weakness.

Most cyclical sectors trailed behind the broader market, but technology and discretionary shares outperformed slightly. In the discretionary space, media and publishing names displayed some strength after Washington Post agreed to sell its newspaper publishing business to Jeff Bezos. However, home builders and retailers lagged. Unlike growth-sensitive sectors, three of four countercyclical groups were able to erase a portion of their losses.

Consumer staples, health care, and telecom services shed between 0.1% and 0.5% while the utilities space underperformed with a loss of 0.6%. Stocks slipped out of the gate after today’s better-than-expected economic data was unable to spark an opening bid.

The trade deficit shrank $9.9 billion to $34.2 billion in June, the smallest gap since October 2009. Economists expected a smaller reduction to $43.5 billion, resulting in the biggest overestimation of the deficit since February 2009.

Elsewhere, the number of job openings rose 0.7% in June to 3.936 million, the highest level since May 2009. The hire rate fell to 3.1% from 3.3%, and has been range-bound for most of the current recovery, reflecting the sluggish pace of employment growth. The layoff and discharge rate fell to 1.1% from 1.3%, while the quit rate was unchanged at 1.6% for the fourth straight month.

As the market slipped, so did our Trend Tracking Indexes (TTIs) with the Domestic TTI ending at +3.51% while the International TTI closed at +7.25%.

Contact Ulli