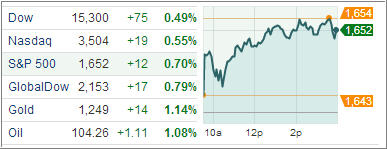

U.S. equities moved higher for a fourth-consecutive day on Tuesday amid optimism companies will report better-than-forecast earnings for the second quarter after Dow member Alcoa bested the Street’s earnings forecasts. Investors are betting that companies will be able to surpass the low bar set for earnings season, leaving room for better-than-expected results that could drive the rally further.

The S&P 500 has recovered all its losses following a 4.8 percent drop between June 19 and 24. The push higher in recent days has taken the benchmark to 1 percent below its all-time closing high of 1,669.16 reached on May 21, the day before Bernanke told Congress the Fed could taper purchases.

Stocks advanced today despite an unexpected decline in small business confidence. The National Federation of Independent Business Small Business Optimism Index deteriorated in June, pulling back from the highest level in a year, declining to 93.5, compared to the improvement to 94.9 that economists had expected.

Hiring plans for the next three months, however, picked up to the best level since last August. Its six-month average also advanced, which suggests the unemployment rate could decline further this summer. Of course, the creation of part-time jobs will likely accelerate at the expense of full time employment as the difference between quantity and quality becomes ever so obvious.

The financial sector briefly dipped into the red before ending with a gain of 0.8%. Growth-oriented groups paced today’s advance even after the International Monetary Fund cut its 2013 global growth outlook to 3.1% from 3.3%.

The industrial sector also finished among the leaders. Another commodity-related sector, energy, rose 1.1% as crude oil climbed 0.8% to $104.00 per barrel. Similar to yesterday, the tech sector trailed behind the broader market. On the downside, the telecom sector shed 0.2%. Meanwhile, other countercyclical groups finished mixed. The pinnacle for the U.S. economic calendar that surely affects the markets will happen tomorrow.

As some attention begins to shift to earnings season, which will heat up later this week, the Fed will be in focus tomorrow with the afternoon release of the minutes from the June 18-19 Federal Open Market Committee meeting, as well as Chairman Ben Bernanke’s speech in Boston after the closing bell.

Following Friday’s stronger-than-expected June nonfarm payroll report, traders are starting to come to grips with the increased likelihood of the Fed tapering asset purchases later this year. Any details pointing to the timing, size, and scope of the scaled-back stimulus discussed among Fed members are likely to garner the most attention and may have a market moving effect.

Our Trend Tracking Indexes (TTIs) joined the party, headed higher and ended the day as follows:

Domestic TTI: +2.08%

International TTI: +4.66%

Contact Ulli