Equity Indexes plummeted and growth stocks got nailed adding to Wednesday’s solid losses, one day after Fed Chairman Ben Bernanke said the Federal Reserve could start scaling back or tapering its monthly bond purchases by year-end.

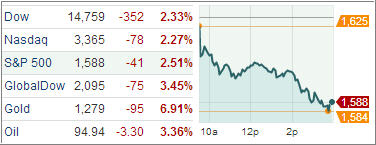

The selling began on Wednesday in the bond market as yields spiked sharply. From the bond trading pits the conflagration spread through Asia to Europe and finally back from where it came in the U.S. The Dow Jones Industrial Average plunged 354 points (2.3%) to 14,758, the Standard & Poor’s 500 Index tumbled 41 points (2.5%), the biggest drop since 2011, to 1,588, and the Nasdaq Composite tanked 79 points (2.3%) to 3,365. In heavy volume, CBOE Volatility Index ended Thursday at its highest level of the year.

All three major averages closed below their 50-day moving averages and took out their June 6 intraday lows. All 10 groups in the S&P 500 declined at least 2 percent. Concerns regarding possible tapering have caused a significant spike in interest rates. Since yesterday, the yield on the 10-yr note has jumped 25 basis points to 2.414%, with ten of those coming during today’s session. But there is more.

High-yielding, defensively oriented sectors led to the downside with consumer staples losing 3.0%. Health care (-2.6%) and utilities (-2.9%) also saw significant selling while the fourth counter-cyclical group, telecom services, outperformed with a loss of 2.3%.

Meanwhile, commodity-related names saw the heaviest selling among cyclical sectors with energy and materials dropping 2.7% and 2.6%, respectively. On a related note, crude oil slumped 3.6% to $94.98 per barrel. This month’s weakest group, financials, finished ahead of the remaining sectors with a loss of 2.2%.

European equities were sharply lower, as they tracked the sell-off in US equity markets yesterday following the Fed’s statements. A report showed that Germany’s manufacturing industry continued to contract. Elsewhere, Stocks in Asia were also tumbled amid the fallout from U.S. Fed. Moreover, a report out of China showed that the region’s manufacturing is shrinking at a faster pace this month, pressuring Chinese equities to trade at near six month lows.

On the economic front, weekly initial jobless claims increased more than expected; the Index of Leading Economic Indicators came in slightly below expectations, while existing home sales rose to their highest level in over three years, and reads on domestic and regional manufacturing activity were mixed.

After seven months of uninterrupted gains for the major stock indexes, the S&P 500 has slipped to a two-week low in two short days and is now 5% below its all-time high set a month ago. The reason why all of these things are happening now is because Ben Bernanke and the Fed think that the risks to the economy have diminished. That begs the question, is the market overacting to Fed?

I think not, as I have repeatedly posted that the extreme high level of the indexes has not been a function of economic fundamentals but merely a result of the reckless money pumping efforts by the Fed. Remember, back in December none other than the NY Fed stated that the S&P 500 would be around the 700 level had it not been for the variety of QE programs, which have lit equities on fire.

Now some reality and/or fear have crept into the markets that the free ride may be over. The last 3 days have done some damage to market direction with our Trend Tracking Indexes (TTIs) having pulled back sharply.

The Domestic TTI is now positioned only +0.76% above its long-term trend line, while the International TTI still hovers at +2.48%.

To refresh your memory, once the Domestic TTI slips into bear market territory, represented as a minus number, we will liquidate all “broadly diversified domestic equity funds/ETFs.”

In the meantime, some of our sell stops got triggered today and those positions will be liquidated tomorrow, unless a strong rebound is in the making, in which case I will hold off another day to potentially avoid a whipsaw signal.

One of our positions has barley triggered its trailing sell stop and here too, I may hold off another day looking for more downside confirmation depending on tomorrow’s activity.

I will post the latest StatSheet later on featuring updated charts and current momentum numbers.

Contact Ulli