Equity and bond index ETFs were battered and beaten on Monday, sending the Standard & Poor’s 500 Index to a nine-week low and adding to last week’s move downward. The focal points on those fronts were the 10-yr note yield, which spiked to 2.66% in early action, and the uncertainty surrounding what impact the Federal Reserve’s potential tapering will have on the economy was exacerbated by festering liquidity fears in China.

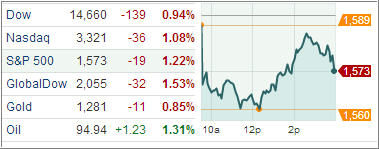

The Dow Jones Industrial Average dropped more than 240 points (or 2%) in early trading, fought back to a loss of nearly 60 points by midday, before tripping up and finishing down 139 points (0.9%). The Standard & Poor’s Index 500 lost 19 points (1.2%) to 1,573, while the Nasdaq Composite declined 36 points (1.1%) to 3,321.

The initial plunge in U.S. markets appeared to be precipitated by China. Chinese equities entered a bear market as the CSI 300 Index of China’s biggest companies tumbled 6.3 percent, the most since August 2009 as depicted by a 20% pullback from recent highs, as banking stocks in China came under heavy pressure. The People’s Bank of China was behind this sell-off but refused to inject liquidity into its banking system. It issued a statement today saying lenders should not expect it to help stem a perceived credit crunch.

Treasury yields continued their rally amid the Fed tapering concerns and as a read on domestic regional manufacturing activity unexpectedly moved into expansion territory. One month ago today the yield on U.S. 10-year notes stood at 2%. Today rates on the 10-year went as high as 2.67% in early trading before inching back over the course of the day.

The 10-year and stocks traded in anti-lockstep today. As rates moved lower during the session stocks moved back to nearly flat. As long as that relationship holds, stocks won’t go anywhere without rates dropping.

Meanwhile, the Dallas Fed Manufacturing Index showed activity for the region unexpectedly rose into expansion territory, increasing from May’s unrevised level of -10.5, to 6.5 in June, compared to the -2.0 figure that was expected by economists.

Economic data this week could add to the case for the Fed to slow purchases. Reports tomorrow may show U.S. durable-goods orders rose and house prices continued to recover. Most strategists do not expect China’s stock market to be poised for a crash, but the outlook is not great. Are we anticipating the same trend for U.S. equities?

Right now it appears that way, as our Domestic Trend Tracking Index (TTI) dropped below its long-term trend line and closed in bear market territory by -0.31%. The International TTI ended the day still on the bullish side but only by +1.11%.

Affected by this Domestic Sell signal are only “broadly diversified domestic ETFs/mutual funds.” As a reminder, for the direction of international funds, you should use the International TTI and for sector/country funds, use their respective trend line breaks and/or your trailing sell stops.

To minimize the chance of a whipsaw signal when using the Domestic TTI, you could alternatively use your trailing sell stops on current positions, if you have not been stopped out yet. In regards to long term trends, we are at that critical junction where a slight rebound could put this indicator back above the line; or, the bears really could take charge, and downward momentum could accelerate.

In my advisor practice, we have liquidated all bond holdings and most equity positions, but are hanging on to a couple of them that have not triggered their trailing sell stops. Any more downside action will likely put us 100% into cash.

Contact Ulli

Comments 2

Ulli, Your yesterdy’s comment that nomally coservative securities

have shown twice the volitility, like SPLV was down about 8% compared to SPY about 4. wonder how that could happen?

RGDS

Maghar

Maghar,

We are having a totally distorted and manipulated market environment and risk on and risk off tendencies switch at a moments notice so that allegedly less volatile ETFs all of a sudden can get very volatile.

Ulli…