Concluding the Federal Open Market Committee’s (FOMC) monetary policy 2-day meeting, Federal Reserve Chairman Ben Bernanke held a press conference and appeared to have hinted that the days of easing may be nearing an end.

The statement from the FOMC was released ahead of the press conference wherein the Fed left the target fed funds rate unchanged near zero and maintained its mortgage-backed securities purchases at a pace of $40 billion per month and longer-term Treasury securities at a pace of $45 billion per month. Stocks finished solidly lower following the news.

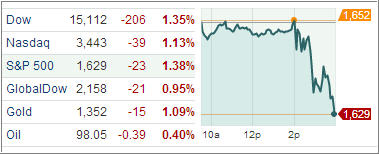

The Dow Jones Industrial Average plunged 206 points (1.4%) to 15,112, the Standard & Poor’s 500 Index tumbled 23 points (1.4%), the most in two weeks, to 1,629, and the Nasdaq Composite declined 39 points (1.1%) to 3,443.

Today’s Statement indicated inflation has been running below the longer-run objective while long-term inflation expectations remain stable. During his remarks, Chairman Bernanke said if conditions continue to improve, the Fed could reduce the pace of purchases later this year with a potential end to purchases coming in the middle of 2014.

While investors had expected the Fed to pull back on its stimulus, his comments gave the most explicit timeline to markets, causing stocks to tumble on heavy volume. In the days leading up to the Fed announcement, stocks had swung between modest losses and breakeven.

Meanwhile, Fed officials forecast the U.S. unemployment rate will fall to 6.5 percent to 6.8 percent by the end of 2014, possibly reaching its stated threshold to raise the benchmark lending rate. The FOMC also anticipates that inflation over the medium term likely will run at or below its 2 percent objective.

Treasuries fell victim to aggressive selling pressure at a loss of more than one point ran the 10-yr yield up 14 basis points to 2.332%. This marked the highest close since March 2012. The sharp spike in rates weighed on rate-sensitive countercyclical sectors as they led equities to the downside.

Telecom and utilities saw respective declines of 2.7% and 2.3% while consumer staples and health care lost near 1.8% each. Meanwhile, most growth-oriented groups held up relatively well through the afternoon selling. Financials and industrials were the two exceptions as both underperformed prior to the FOMC Statement, and lagged behind other cyclical sectors into the close. Energy and materials outperformed the broader market with respective losses of 1.0% and 0.8%.

It will be interested to see how the markets, including Europe and Asia, react to this news from the Fed in coming days and if the always present dip buyers will step back in and push the indexes back up.

Our Trend Tracking Indexes (TTIs) headed south as well with the Domestic TTI closing at +2.16% while the International TTI ended this volatile day at +4.99%.

Contact Ulli