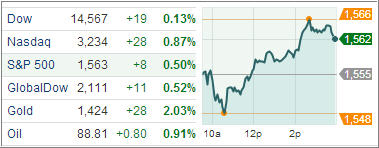

The market returned from the weekend with some modest gains, after the biggest weekly loss in five months for the Standard & Poor’s 500 Index. The S&P 500 increased 0.5 percent while the Dow Jones Industrial Average rose a meager 0.1%. Energy and materials shares were among the best performers of the day on the S&P 500, bouncing back from last week’s big losses.

The market slumped early on as existing home sales fell 0.6% in March to a 4.92 million unit annual rate, according to the National Association of Realtors. Economists expected a 0.8% increase to a 5.02 million unit rate. Both single-family and condo/co-op sales edged down, but both continued on their upward trend.

The shortage in existing home inventory was likely the main reason for the pullback in activity. However, low inventory pushed up prices. Median prices have increased 11.8% from a year ago, the most since November 2005. Although most releases still indicate economic expansion, data of late has been modestly disappointing, raising the prospect of at least a minor soft patch. Although today’s report was not short of disappointment, it had some potential positives as sales have been above year-ago levels for 21 consecutive months. Also, the inventory issues could lead to a future ramp up of construction.

The big earnings week began with Caterpillar’s miss. The Dow member reported dismal 1Q earnings of $1.31 per share, below the $1.40 consensus estimate, with revenues falling 17.3% year-over-year to $13.2 billion, compared to the $13.8 billion expected. Caterpillar expressed optimism on U.S. housing, but said a 50% reduction in mining related businesses and little to no inventory build going into summer planting season will hurt results. CAT cut its 2013 guidance for both earnings and revenue, noting that it is concerned about economic growth in the US and China.

I wonder whether or not weakness in Caterpillar’s outlook bodes ill for the economy and the markets as a whole. About 30% of the S&P 500 companies will be reporting earnings results and offering guidance in coming weeks, along with the first estimate of GDP to be released on Friday morning; maybe at that time the global growth path will offer a hint of things to come.

Our Trend Tracking Indexes (TTIs) edged slightly higher with the Domestic TTI closing the day at +2.99%, while the International TTI reached +5.86%.

Contact Ulli