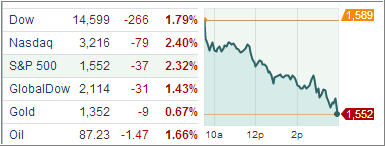

The week kicked off on a decidedly down note. Stocks sunk deep into the red on Monday. The major averages suffered sharp losses as the chart above shows. The S&P 500 posted its worst day in more than four months. As explosions rocked the finish line area of the Boston Marathon, stocks extended losses even further by closing bell. It was simply a bad day all the way around.

China’s economic growth unexpectedly slowed down. According to the Chinese National Bureau of Statistics, the country’s Gross Domestic Product rose 7.7 in the first quarter from a year earlier. The median forecast in a Bloomberg survey of economists was 8 percent. Fourth quarter growth was 7.9 percent. Many reports showed March industrial production rose less than estimated while retail-sales growth matched forecasts. Global growth is threatened as the Chinese numbers start to disappoint; after all, it’s supposed to be the little engine that could…

As fears of a slowdown in the world’s two biggest economies accelerated, prices of oil, gold, silver and other commodities tumbled. Mining and energy shares were hit hardest in the stock market today as the result. Gold was diving 9.5%, reaching at its lowest level since February 2011, falling $143 an ounce to $1,358.40. Silver was also slumping, shedding 11.8% to $23.23 an ounce. Shares of mining companies suffered astonishing selloffs. Many hit their 52-week lows, or worse. This sector is much weaker than the market overall, which was down in its own right.

Homebuilders weakened after the National Association of Home Builders/Wells Fargo housing-market index, a gauge of confidence among builders, hit its lowest level in six months. It dropped to 42 in April from 44 in March.

Monday’s stock sell-off and rout in gold are almost certain to test any recent excitement for investing. Investors’ reticence to embrace the rally mainly pointed to trust, or lack thereof. A still sluggish economy, high unemployment, falling median household income, fresh scars from the Great Recession, as well as bad memories of the bursting of the Dot.com and housing bubbles all contributed to investors’ lack of faith in the market.

According to the Chicago Booth/Kellogg School Financial Trust Index, more than half of Americans (58%) think it’s likely that the stock market will drop by more than 30% in the next 12 months while only 22% say they trust the financial system.

Our Trend Tracking Indexes (TTIs) joined the major indexes and headed south, but remain on the bullish side of the trend line. The Domestic TTI closed at +2.86% while the International TTI ended the day at +5.93%.

A correction was well overdue, but it’s too early to tell if downside momentum will accelerate further or if the dip buyers step in and prop this market back up.

Again, it’s important that you know when to exit based on your trailing sell stops. While today could be just a momentary pause in an ongoing uptrend, it could also be the beginning of the end of the Fed sponsored lift-a-thon, so be prepared to deal with either scenario.

Contact Ulli