US equity markets started the second quarter on a cautious note, with two benchmark indexes retreating from record highs, after a closely watched manufacturing index declined unexpectedly in March.

The Tempe, Arizona-based Institute for Supply Management’s factory index fell to 51.3 in March from 54.2 in February. Any reading above 50 signals expansion. At the same time, the new-orders index, a gauge of future demand, fell to 51.4 from 57.8 in February. The production index dropped 5.4 percent to 52.2. The loss of momentum in sales and production could be an indication of an economic slowdown in the second quarter.

Economists expect growth to slow to 2.2 percent from an estimated 2.8 percent in the first quarter.

A separate report showed construction spending climbed in February, boosted by the highest level of home building in more than four years. A Commerce Department report showed spending in February grew 1.2 percent to a seasonally-adjusted annual clip of $885.1 billion.

Separately, Markit’s reading of US manufacturing came in at 54.6 for March, slightly falling short of the 55 level forecast by analysts.

Data released on Friday showed consumer spending rose in February by the most in five months and confidence surged unexpectedly in March, indicating job gains are helping Americans offset payroll tax increases and overcome concerns about federal budget cuts. Markets were closed on Friday for Easter.

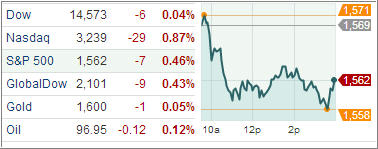

After sliding as much as 47 points, the Dow Jones Industrial Average (DJIA) finished 6 points lower while the S&P 500 Index (SPX) dropped 7 points to 1562.17 with industrials, raw materials and technology firms hitting the ground hardest among its 10 business groups.

Treasuries prices rose, pushing the benchmark 10-year yields to a near four-week low after a measure of American manufacturing fell short of forecasts, increasing demand for safer assets.

Yield on 10-year Treasury notes fell two basis points to 1.83 percent while yield on 30-year Treasury bonds declined three basis points to 3.08 percent.

The US dollar slipped against most of its major trading rivals with the Japanese yen hitting a one-month high after data showed an unexpected decline in US manufacturing, easing concerns the Federal reserve will taper its accommodative policies.

Markets in Frankfurt, Paris and London remained closed for an extended Easter holiday.

Our Trend Tracking Indexes (TTIs) slipped with the International TTI retreating more sharply; however it still remains solidly on the bullish side of the trend line by +6.85% while the Domestic TTI ended this first day of the second quarter at +3.31%.

Contact Ulli