The major market indexes mostly rose Thursday, with the Dow Jones gaining for a fifth day and the S&P 500 briefly topping the 1,500 mark as an unexpected drop in unemployment claims and upbeat corporate results offset the worst decline for Apple Inc in four years.

Apple Inc slumped 12 percent to $450.50 after reporting the weakest sales growth in 14 quarters even though earnings in the latest quarter climbed to a record $13.1 billion. The shares have shed 15 percent this year for the worst performance in the S&P 500, and have lost 36 percent since hitting an all-time high in September. The smartphone maker forecast sales of $41 to $43 billion in the fiscal second quarter underway now, compared with $45.5 billion in sales predicted by analysts.

Equities surged earlier today as a Labor Department report showed claims for unemployment benefits fell by 5,000 last week to 330,000, although the fact was ignored that data was incomplete due to 3 states not having reported yet, and their numbers were estimated. But nowadays, that does not matter as long as the market indexes have a reason, any reason, to close in the green.

Separately, a Conference Board release showed the index of economic indicators climbed 0.5 percent in December, keeping hopes for a sustained recovery alive.

In China, manufacturing expanded at the fastest rate in two years in January, the preliminary reading of the HSBC Purchasing Manager’s index revealed. The European purchasing manager’s index rose for a third consecutive month in January, according to flash estimates from Markit.

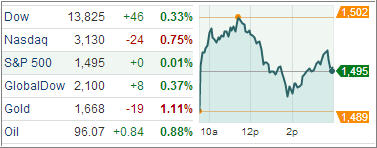

The Dow Jones Industrial Average (DJIA) zoomed 46 points, with Boeing and Cisco leading the gains. Hewlett Packard and Walt Disney finished the day unchanged.

The S&P 500 Index (SPX) rose fractionally, adding 0.01 point with consumer discretionary and healthcare gaining the most and technology and basic materials faring the worst among its 10 business groups.

Treasury prices dropped, pushing the benchmark 10-year yield up from near three-week lows as lower-than-estimated jobless claims boosted confidence and the US raised $15 billion in inflation-indexed debt at negative yields.

European stocks finished mostly higher Thursday, pushing the pan-European Stoxx Europe 600 index to its highest level since February 2011 as upbeat global manufacturing data boosted risk sentiment.

In the ETF space, the tech-laden PowerShares NASDAQ ETF (QQQ) slumped 1.38 percent, weighed down by a 12 percent slide in Apple.

The Market Vectors India Small-Cap Index (SCIF) ETF was among the biggest decliners, sliding 4.89 percent on the day.

The MSCI Japan Index Fund (EWJ) rose 1.14 percent after Japanese stocks rallied as the yen hit fresh multi-year lows.

In regards to the big picture, our Trend Tracking Indexes (TTIs) offered a mixed view as the Domestic TTI slid to +3.20%, while the International TTI inched modestly higher to +10.75%.

For all of the latest charts and momentum numbers, please see the most recent StatSheet, which I will post shortly.

Contact Ulli